Hobby Farm Dwelling Insurance

(Because you want the best coverage and the best price)

Candace Jenkins is a licensed insurance advisor with over a decade of experience. She is also a writer and loves to write on all things insurance. Candace writes for TrustedChoice.com on a continuous basis and is here with the facts about all your insurance inquiries.

What's a hobby farm without a barn? You've got to have somewhere to store your farm equipment and livestock. Making sure you have the right insurance for your barns is key in keeping your hobby farm running without major out-of-pocket expenses. That's where an independent insurance agent is important.

Your independent insurance agent is a knowledgeable resource when it comes to insuring all aspects of your hobby farm, including your barns and other structures. Knowing how coverage works and where to get it is essential in running a hobby farm, so let's start with a little background.

How to Insure Your Hobby Farm's Barn

Insuring your hobby farm is one thing, but your barn is another. Your barn insurance policies are typically separate from your overall farm coverage, though they can be included depending on your insurance carrier.

First, you'll need to have your independent insurance agent look at pricing and coverages for your barn's specifications. So whether you have a multi-story decked-out, fancy barn you could hold weddings in, or a simple one-level structure, your coverage needs to apply adequately.

Your independent insurance agent will need to know the following to get started:

- Your barn's specifications: What's the square footage of your barn? What are the finishes in the barn, such as flooring, stables, and more? What material is your barn made of? When was it built? What's the barn used for?

- What is your barn worth: This isn't the sentimental value, but what is the replacement value of your barn, meaning what will it cost to replace your barn to like, kind, and quality?

- What preemptive protection do you have in place: Are there security cameras or alarms in place in case of theft or vandalism? Is there a fire extinguishing system in case of fire? What measures are in place to keep predators, like wild animals, out?

When to Insure Your Barn and Other Structures

Time is of the essence. If you have an uninsured barn or other structure already, then you'll want to get a policy in place as fast as you can. Get your independent insurance agent on the line. If you're looking at building a whole new barn, then you'll want to make sure you have insurance in place before, during, and after the building process.

No matter where you are in the barn process, your independent insurance agent is just the person to help you through it all. They'll make sure you have the right coverage for your specific barn and its needs.

Cost of Insuring Your Barn

Take a moment and gather some cold hard facts on barn numbers in the United States. The amount you could spend on barns is no joke and it's worth the look. And as expensive as they can be to build, the cost of insurance is definitely worth it to protect your hobby farm.

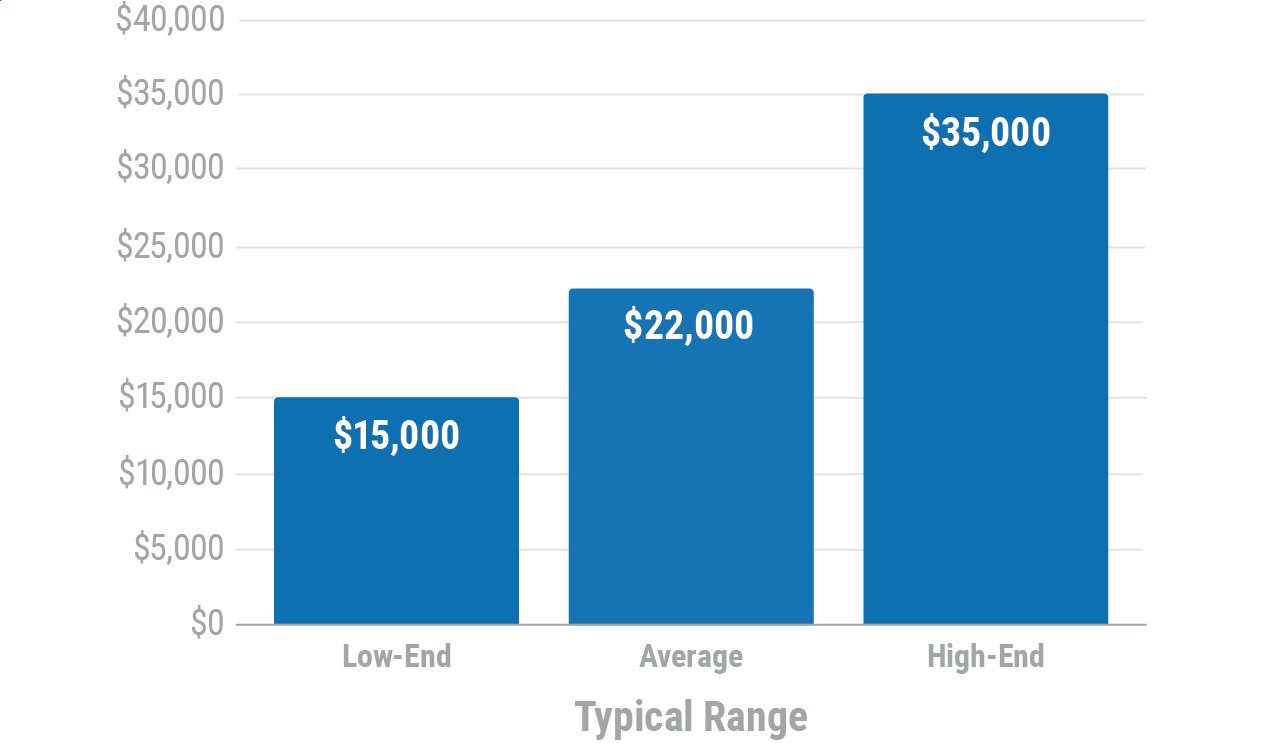

Average Pole Barn Prices

The cost of insuring your barn, however, is dependent on the specifics of your barn, what your barn is worth, and how much coverage you exactly need. Every hobby farmer has different needs resulting in different pricing. Speaking with your independent insurance agent will get you exact information on coverage and cost.

What Does Barn Insurance Cover, and What Does It Not Cover?

When it comes to insuring your barn, you should have a pretty good idea of what goes into it by now. But what you need to know now is what the policy will cover and what it won't.

What your barn insurance generally covers:

- Accidents: This can be coverage for fire damage, smoke damage, or things of a similar nature.

- Natural disasters: Volcanic eruption and sinkholes are covered, but typically, floods and earthquakes are covered under a separate policy.

- Weather events: Lightning, wind, hail, tornados and more are covered.

- Crimes and civil unrest: This is for theft and vandalism of your barn and other structures.

- Replacement of your barn and other structures: This provides coverage for your barn, so if any of the above claims occur, then you will get either full replacement cost, the market value of the item, or the depreciated value of your barn. This is all dependent on your policy specifics, so discuss it with your independent insurance agent.

What your barn insurance doesn't cover:

- Natural wear and tear: Insurance policies aren't maintenance policies, so it's best to be prepared.

- Farm equipment and heavy machinery: This will be covered under a separate policy or another coverage within the main hobby farm policy.

Barn Liability Insurance

If you’re found to be legally responsible for causing bodily injury or property damage to other people or their property as a result of them being in your barn or other structure, you’ll have coverage under the liability portion of your policy. Between that and all the other coverages your hobby farm policy provides, it looks like you'd be in pretty good shape.

Your independent insurance agent can discuss all facets of your hobby farm and barn policies, making sure you've got the proper coverage in every area. If your use of the barn is a large risk, they may recommend umbrella coverage to help increase your protection.

The Benefits of an Independent Insurance Agent

Independent insurance agents have access to multiple insurance companies, ultimately finding you the best coverage, accessibility, and competitive pricing while working for you. And as your hobby farm grows and your needs change, they'll be there to help you adjust your coverage, up or down, to make sure you're properly protected without overpaying. Find a TrustedChoice.com independent insurance agent in your community here.

https://homeguide.com/costs/pole-barn-prices