How to Calculate Workers' Comp

Find out what to expect when you're looking for a Workers' Comp plan

Learning how to calculate workers' compensation insurance is important when you're trying to figure out your bottom line. Business expenses are no joke and profitability is the end game, so knowing the facts can set you up for success.

An independent insurance agent is a key advisor for every business owner when it comes to workers' compensation insurance and how to calculate it. Having the agent in your corner with the best options is a pretty good place to start.

What Is Workers' Compensation Insurance?

First things first, you need to know what workers' compensation insurance is before you can know the laws that govern it. Workers' compensation insurance is an insurance policy taken out by an employer or independent contractor that will help pay for medical expenses of an injury or illness that occurred while working or as a result of an employee's job.

This policy will also pay for partial wages, usually up to two-thirds, for any employee, included owners, or independent contractors while they're recovering. An independent insurance agent is a great resource to have when it comes to knowing the ins and outs of workers' compensation coverage. If you are self-employed, you can still get self-employed workers' comp insurance.

How to Calculate the Cost of Workers' Compensation

There are a variety of factors that go into a workers' compensation calculation, but in general, the formula can be pretty basic if you have all the components and your business is pretty cut-and-dried. It's when you add more moving parts that things can get hairy. Knowing some terms before knowing the general formula is key to better understanding this mathematical insurance equation. You can only get a final estimate for your workers' comp by getting an online quote, but you can also use a workers' comp insurance calculator to get a starting idea.

Terms needed to understand workers' compensation formula:

- Experience modification rating aka MOD: This is a business' score care and is a number system that tells the insurance carrier your loss history rating. The fewer and lower-paid claims you've had in the past, the better the rating.

- Classification code (aka class code): This is how the insurance company classifies each employee type. They take the job duties of each employee type and put them into a classification code with an amount that is paid per $100 dollars of payroll assigned to that classification code or employee type. For example, a clerical worker has a classification code of 8810, and let's say the average rate for an 8810 classification code is $0.43 per $100 in payroll.

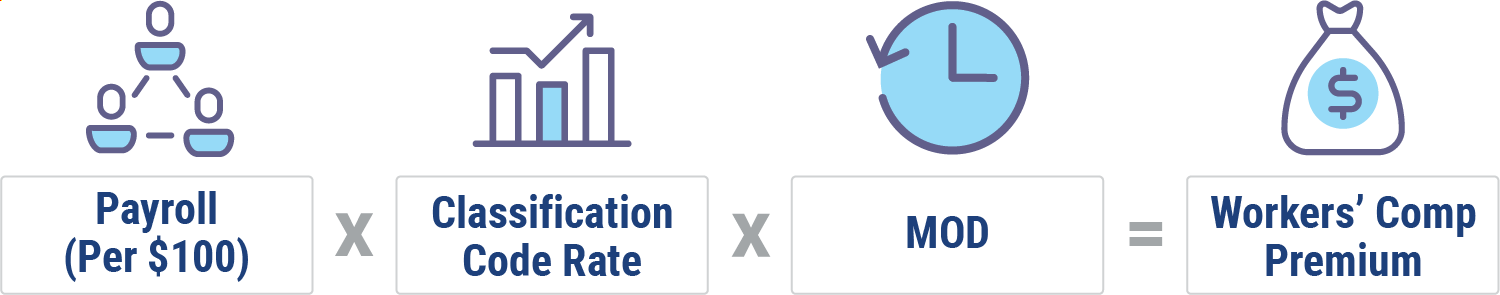

General formula:

- Multiply your payroll by your class rate and divide by 100. (Using the 8810 class code example above, and assuming your payroll for that code is $100,000, multiply $100,000 x $0.43 = 43,000 / 100 = $430.)

- Multiply that number by your experience rating modifier, if applicable. (For example purposes your experience mod is 0.8 giving you $430 x 0.8 = $344.)

There you have it. The premium amount for that class code with $100,000 in payroll would be $344. Now, most insurance companies and states have a mandated minimum premium, meaning they would likely have a minimum amount of $750 or more that they would charge to make it worth their while. But you get the gist.

Average Workers' Compensation Cost in the US

The average workers' compensation rates for every $100,000 in payroll can range from a few hundred dollars in premium to a few thousand dollars in premium. Depending on what state you are in, what coverage you have selected, and what industry you are in are all varying factors.

To know what the amount is specifically for your area of work and risk factors, call your local independent insurance agent to go over the numbers. There is nothing better than taking pencil to paper and hashing out the budget-making expenses that serve your bottom line.

How Much Are Out-of-Pocket Costs?

If you have a good independent insurance agent, then you shouldn't have any out-of-pocket costs besides maybe a deductible. A vetted and experienced agent will make sure they have taken into account the full scope of business operations so they are covering every aspect of your business.

They will also make sure your employees are classified properly and that wages are accounted for in the right manner. If this doesn't sound like something you are currently experiencing now, then it may be time to find out where and with whom you can get the correct information. After all, your business is too precious to squander all the profits away in an improperly covered claim that could have been avoided. If it is time for you to make a workers' comp claim, make sure you do it right.

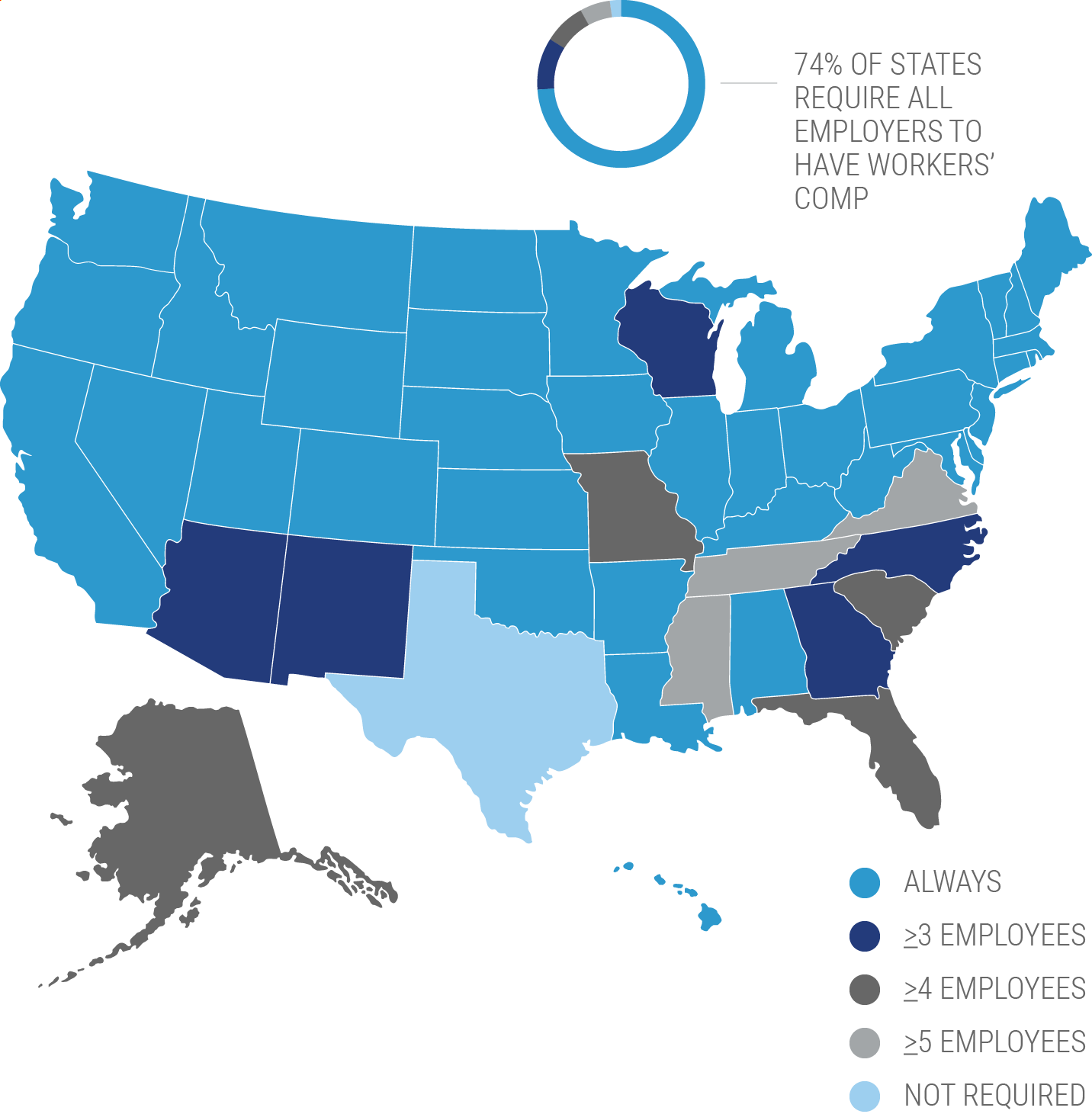

Are Workers' Compensation Premiums State-Specific?

Each state has it's own workers' comp state laws because each state {except for Texas} has mandated workers' compensation coverage in some form or another. They all have their minimum premiums that are required, and they vary from state to state. They also have different rates per class code in each state, and they are usually pretty similar. But it just depends.

Checking with your agent on your state specifics will set you on the right track and on the path to better and more affordable workers' compensation coverage.

Workers' Compensation Cost Variants

Workers' comp policy costs vary. It's a vast numbers game when it comes to risk factors and industry types concerning workers' compensation insurance. The only true way to know is to have your agent run the numbers on your business and its specifics. While it's near impossible to know what your individual workers' compensation premium will be, here are some determining factors you can look out for.

Workers' compensation price-determining factors:

- Industry: This plays a big part in the cost of your workers' compensation premium. The riskier your business, the more your premiums will be.

- Number of employees: This determines how much your rates will increase. More people equal more money.

- Gross annual payroll per employee type: Each employee is given a classification code that classifies their job duties and then charges the premium according to how risky or not risky their tasks are. The amount of money you pay them will determine the amount of premium per classification code. The more payroll, the more premium you pay.

- Experience modification rating: If your business has had workers' compensation insurance for a total of three years or more, and you are paying over $5,000 in annual premium, then you'll be assigned an experience modification rating, aka "mod." This mod will adjust throughout the years depending on the number, length, and frequency of claims turned in. The better the mod, the better rate you will receive. It's kind of like a credit score for your workers' compensation policy.

What Is Not Covered by a Workers' Comp Policy?

By now you should have a pretty good understanding of how to calculate workers' compensation insurance. What you need to know is what it's not going to cover. A good place to start is with a workers' compensation policy as a whole.

What's not covered under a workers' compensation policy:

- Full wages: This is lost income, and it will only cover partial usually up to two-thirds of regular pay.

- Non-work related injury or illness: This is crossing the line into insurance fraud which is discussed next.

- Coverage more than what is offered on the policy: Once your policy limits are exhausted for any one claim, that's it. There is no more coverage and it has officially become a personal problem.

Comparing Workers' Compensation Rates and Policies

Each industry has a different rate based on the risk involved. Each employee type has a different classification tied to a premium amount per classification and gross annual payroll paid per employee type. Again, it depends on the risk factors in each industry, within each employee classification type, and within each company.

For example, a restaurant owner and a hotel owner both have similar industry types because they are both considered to be in the hospitality industry. The employee types of each establishment are a bit different but also very much the same. Each industry has a host or greeter, each industry has food or a kitchen involved in some form or another, and each industry has a cleanup or janitorial service involved. These two industries would have similar workers' compensation ratings.

Benefits of an Independent Insurance Agent

Independent insurance agents have access to multiple insurance companies, ultimately finding you the best coverage, accessibility, and competitive pricing while working for you. And as your company grows and your needs change, they'll be there to help you adjust your coverage, up or down, to make sure you're properly protected without overpaying. Find an independent insurance agent in your community here.