Architect Insurance

Architects need multiple types of liability protection and coverage for their business property and employees.

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

As an architect, you’re responsible for bringing designs to life. From conception to realization, you’re part of the process of creating an architectural structure that people will use for many years to come. Your work must meet client expectations, and there's risk involved in that. Professional errors or omissions could lead to unhappy clients, which in turn could lead to a lawsuit against you. Having the right protection is critical.

Fortunately, a local independent insurance agent can help you get set up with the right architect insurance. They'll ensure you get protected not only from a liability standpoint but from every necessary angle. But first, here's a closer look at architect insurance, what it covers, how much it costs, and more.

What Is Architect Insurance?

Architect insurance is a special package of business insurance designed to meet the needs of professionals in the architectural field. These policies include crucial forms of liability protection that can provide reimbursement from lawsuits for oversights, property damage, and more. A complete architect insurance policy also often includes coverage for your business property and vehicles, employees, and temporary shutdowns.

What Does Architect Liability Insurance Cover?

Architects commonly need at least two forms of liability insurance. Having both kinds of coverage can protect you and your business from different types of common lawsuits. Architects often get the following:

- Professional liability insurance: This coverage can reimburse you for expenses related to third-party claims of professional errors and negligence by you or your architectural firm.

- General liability insurance: This coverage can reimburse you for expenses related to third-party claims of bodily injury or personal property damage by you or your architectural firm.

Both of these liability policies can reimburse you and your business for various expenses associated with lawsuits, including attorney and court expenses and any settlements or judgments you're ordered to pay. Since just one unexpected lawsuit can cost your business several thousand dollars or more to settle, having the right liability protection is essential to your business's longevity.

Common Liability Claims Against Architects

As an architect, you're especially vulnerable to lawsuits filed against your business by clients who are dissatisfied or who have otherwise been harmed by your work. Architects can be sued for professional negligence for a variety of reasons, such as:

- Bad or erroneous design (e.g., a house sustains water damage due to design errors)

- Wrong materials used (e.g., flooring)

- Failure to communicate changes in plans, materials, timelines and other important information about a project

- Failure to complete a project on time

- Failure to complete a project within budget

Whether you operate a large architectural firm or are a sole proprietor, having architect professional liability insurance is a necessary part of running your business.

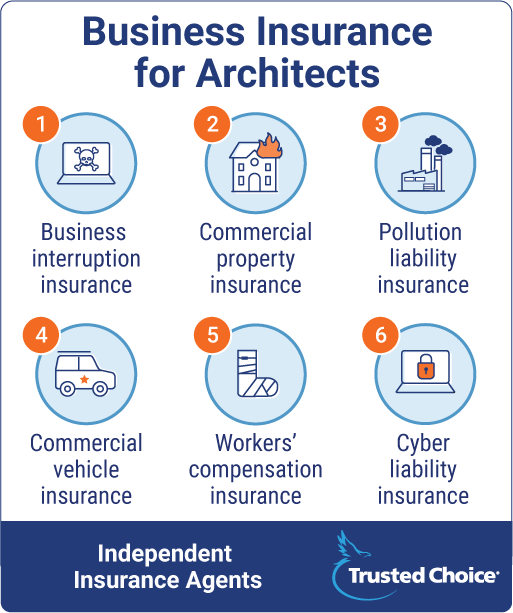

Additional Business Insurance for Architects

The architect insurance you need depends on whether you work independently or run an architectural firm. Some of the basic business coverages you may need to protect your company include the following.

- Business interruption insurance covers ongoing business expenses if your company must temporarily close down due to a covered disaster, such as a fire.

- Commercial property insurance: If your office building or professional equipment is damaged due to a covered cause of loss, your insurance policy can help pay for repair or replacement.

- Pollution liability insurance: With any form of construction, there’s a risk of runoff or air pollution. If your work causes damage to the environment, this coverage assists you with the cost of cleanup efforts and associated lawsuits.

- Commercial vehicle insurance: Whether you have a small company or a large architectural firm, you most likely have company cars. This coverage can protect your business vehicles against many threats, including vandalism and theft.

- Workers' compensation insurance: If you have employees, this coverage can reimburse them for lost income and pay for medical expenses if they develop a work-related illness or injury.

- Cyber liability insurance: This coverage can reimburse your business for expenses associated with incidents of data breach or cyber-attacks that may expose or sell sensitive and private data and records.

Workers' compensation laws vary by state, and your business will likely be required to have coverage if it has employees. Be sure to discuss your business insurance needs with an independent insurance agent who can ensure you're in compliance with your state's regulations.

What's Not Covered by Architect Insurance?

Architect insurance comes with various exclusions that you should familiarize yourself with before you ever need to use your coverage. Often, architect insurance won't cover the following.

- Criminal activity

- Intentional or malicious acts against others

- Damage to business property by floods or earthquakes

If your architectural firm is located in an area prone to floods or earthquakes, ask your independent insurance agent about adding coverage for these natural disasters.

How Much Does Architect Insurance Cost?

The cost of architect insurance can vary based on many factors, including your business's location, size, number of employees, annual revenue, services offered, claims history, and more. However, the average cost of architect professional liability insurance is $145 monthly or $1,730 annually.

Here are some additional average costs for architect coverage:

- Architect general liability insurance: $35 monthly or $425 annually

- Architect workers’ compensation insurance: $50 monthly or $600 annually

A local independent insurance agent can help you find affordable architect insurance near you. They'll help you find any discounts your firm is eligible for.

Best Architect Insurance Companies

Ready to buy architect insurance? We've compiled a list of some of our top recommendations for quality architect insurance for your convenience. An independent insurance agent can help you buy a policy from any of these outstanding carriers.

Top Architect Insurance Companies - Overall Carrier Star Rating

| Top Architect Insurance Companies | Overall Carrier Star Rating |

|---|---|

| Travelers | |

| Progressive | |

| Nationwide | |

| USAA | |

| Hiscox | |

The Benefits of an Independent Insurance Agent

When it comes to helping insurance customers find the absolute best architect insurance, no one’s better equipped to help than an independent insurance agent. Independent insurance agents search through multiple carriers to find providers who sell architect business insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

https://www.thehartford.com/professional-liability-insurance/architect

https://www.nerdwallet.com/article/small-business/architect-insurance