Restaurant Insurance in Rhode Island

Because your business is worth protecting.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

You’re better than a backyard barbecue or bake sale. You’ve got a building. You’ve got a menu. You’ve got a dream. And you’re about to mix up all those ingredients into a spicy little spot that all the locals are going to love. And while restaurant insurance isn’t the most glamorous part of the process, it has to get done.

This is where an independent insurance agent comes in. They’re like the person who actually enjoys doing their homework and checking it twice. And when they do that so that your restaurant is covered no matter what happens, it’s a beautiful thing.

What Is Restaurant Insurance?

Restaurant insurance is a lot like it sounds: It's insurance for your restaurant - all aspects of your restaurant. This means that it covers obvious things like your building and your personal property in the building. But it also covers things like liability, which could be to customers if you make them sick or they're injured while on your property, or employees, if they're hurt on the job.

While this might seem like a lot to worry about, you aren't on your own. An independent insurance agent will run down all of the risks and problems and make sure that you don't have anything to worry about.

What Type of Restaurant Insurance Coverage Do I Need in Rhode Island?

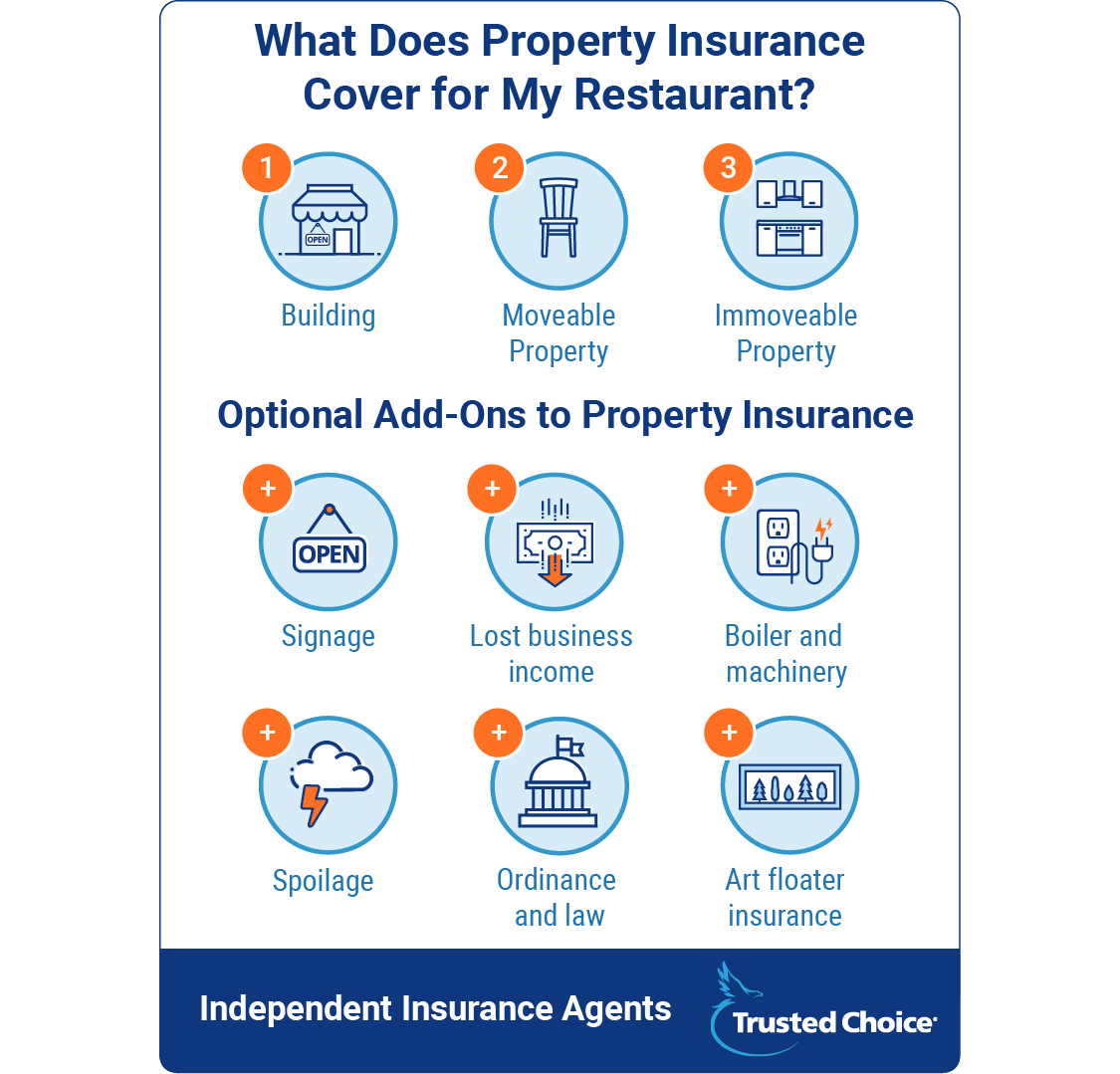

Property can be real (like the building itself) or personal. Both of these types of property are covered under your general policy with one caveat: The personal property that's covered is property you can move. This is your standard tables, chairs, décor – literally anything you can pick up and put down somewhere else.

Now if you can put two and two together (which we're confident that you can), you realize that we distinguished movable personal property because there’s also another type of personal property: immovable. Generally this covers your kitchen equipment and maybe even some built-ins, like a bar. It's stuff that's literally bolted down to your building.

One last thing to note before considering specialty policies is that straightforward factors can affect your property coverage costs. The most significant is your kitchen equipment. If you're cooking over open flames or have other dangerous tools, property coverage is going to cost more than for a restaurant that has a similar building and property, but safer equipment. This is because if you have a dangerous kitchen, fires and other issues are more likely (and you'll pay more for that).

Then there’s the rest of your property. This is stuff like:

- Your sign: Signs can cost tens of thousands of dollars. This includes your restaurant sign, along with your drive-thru sign (if you have one of those). This would protect a sign if it's vandalized, if a natural disaster happens, or if either sign is hit by a car.

- Lost business income: Your business could be shut down at one time or another. This could be because of a kitchen-related issue, like a fire, or some kind of natural disaster , like a hurricane. It'll pay your bills, along with employee salaries, while you repair or rebuild.

- Spoilage: This covers the money you lose if food spoils because of a refrigeration or freezer issue.

- Boiler & machinery: This coverage kicks in if you have electrical or plumbing damage when there’s an equipment breakdown. It won't cover the cost of the equipment itself, but it does cover this associated damage.

- Ordinance and law: State codes matter and it's important to be covered if you come up short. Relevant factors would include things like handicapped-compliance, fire safety features, and emergency exits. If you ever have to rebuild your restaurant, or have chosen to build it from the ground up, this coverage is important, too.

- Art floater insurance: If you have specialty property, like art, get it appraised and then get it covered under one of these policies. It will ensure you're paid what the property is actually worth if something is lost due to theft or destruction.

Hurricane Property Damage Coverage

Rhode Island is on the coast, so hurricanes are always a possibility. Hurricane damage isn't typically covered under a general property insurance policy, so special coverage is something you should consider.

Better yet, it's something you should discuss with your independent insurance agent.

Risk and Liability Coverage

Risk is related to liability coverage. And you have risk because you have customers who are coming into your restaurant and sticking around. Liability coverage means that you’re covered if a customer gets sick from your food or slips and falls. This could happen in the parking lot or in the restaurant – it doesn’t really matter where.

One of the most common types of liability coverage is communicable disease. This protects you if an employee makes a customer ill because of poor hygiene practices.

Then there’s liquor liability coverage. If you distill, brew, or sell alcohol, you need to get covered. If you only have a general liability policy, an accident that happens because one of your customers was overserved isn't going to be covered. But with a liquor liability policy, property damage and bodily injury are both covered. Keep in mind that liquor liability is much more common for smaller restaurants, simply because larger restaurants and chains tend to have stricter serving policies. But again, it's best to run this by your independent agent so you're safe, not sorry.

Directors and officers liability is one final type of liability coverage you may want to consider. It’s what you need when stockholders, employees, or cities decide that you didn’t make a good business decision and they want to sue. There doesn’t even need to be an injury, either. If you’re reading this and feeling a bit lost, that’s natural. You might not even need to worry about this at all. Luckily, your independent insurance agent will give you a heads up if you should be concerned about this.

Workers' Compensation Insurance for Rhode Island Restaurants

If you live in Rhode Island, you’re legally required to purchase workers' compensation coverage. Workers' compensation is pretty straightforward. If your employee gets injured on the job, workers' compensation will pay for:

- Medical expenses

- Lost wages

- Rehabilitation costs

Employment practices liability insurance is the other type of insurance that is employee-related. There’s just one catch: This is protection against employees if one of them sues you. This would be your typical sexual harassment, discrimination, or hostile work environment case.

Features To Consider

Now you’ve got the basics down, but coverage complications don’t end there. You’ve also got features to worry about. Features matter because they can create more risk (or take it away, in some cases). Or, if you’re really lucky, your feature won’t cost more in insurance premiums but will add earnings to your business.

A drive-thru costs you very little in additional insurance coverage. It's basically just the property coverage for the additional sign and for the pavement. But the convenience of having a drive-thru could be a real asset to your business. Technically, buffets don’t cost more either, but underwriter bias might mean that you pay a little bit more because underwriters don't usually like buffets.

Then there are features that do change coverage. Whether you’re dine-in vs. carry-out will change coverage. Dine-in restaurants will need more property and liability coverage. They tend to be larger restaurants and customers spend time there, meaning they could slip and fall. There are also more employees: You need a wait staff, after all. Carry-out restaurants have fewer employees and a smaller space, and customers are on the premises for just minutes, if that. The difference is pretty clear, here.

One last feature is delivery. Delivery services affect liability coverage because you have to cover the vehicles. Now, no shade meant in the direction of most delivery drivers, but their cars aren’t typically in tip-top shape. This means that you’ll pay more to keep them covered. You could fork out some cash and pay for delivery vehicles. This will lower your premium, but it comes down to your own cost-benefit analysis. Oh, and if your restaurant is a food truck, you'll need liability coverage for that, too.

How Much Does Restaurant Insurance Cost in Rhode Island?

We know this is the heading you scrolled down to as soon as you landed on this article. We accept that. And we have good and bad news: We have an answer for you.

The good news is that we can tell you how you’re going to pay for restaurant insurance in Rhode Island. You’ll pay separately for:

- Workers' compensation, because it’s priced per $100 of payroll and by risk classification (meaning the more sharp objects, hot oil, and open flames you have, the more you’ll pay)

- Property and liability coverage

Property and liability can range from as little as $10,000 annually to $100,000 annually. It all just depends on your restaurant. Let’s say you’re just going to open a corner taco stand. You don’t have to do much prep, you have minimal property, and you probably don’t have many employees. That all means that you won’t have much insurance coverage to pay because all of your risk is generally low. That also means that if you're looking to start an inexpensive/low-risk restaurant, this is the way to go.

On the opposite end of the extreme spectrum is what you’ll pay if you operate a multi-chain restaurant. Now, $100,000 is a bit on the high end and it would mean there are a lot of locations. But you have to consider how much property there is to cover, how much liability you have for all the customers that will be in and out, and how many employees you’ll need to operate. Then there are the special policies for these kinds of larger restaurants, like directors and officers liability. It goes without saying that these are going to be the more expensive/riskier endeavors you could start. Your independent insurance agent is key to helping you navigate these twists and turns regardless, but will become especially useful as your restaurant gets bigger.

Have You Talked to Your Independent Insurance Agent?

OK, so maybe you haven’t called yet, since you just got to the end of this article. But if you’re opening a Rhode Island restaurant, your independent insurance agent will get you on the right track for all of your restaurant insurance needs. Better yet, they'll shop around for your policy and get you the best coverage at the best possible price.

So what are you waiting for? Get in touch with your expert, and get covered.