Alaska Restaurant Insurance

Because it's time to make that dream a reality.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Turning the vision of running your own restaurant into a reality can bring a lot of rewards, but it can also bring plenty of potential risks. In addition to serving food to the willing public, your business has to look after its employees, and stand up against the elements of Mother Nature. Luckily, that's where restaurant insurance comes in to save the day.

Our independent insurance agents are here to break down all kinds of Alaska restaurant insurance, from the coverage needed by muktuk stands all the way to all-you-can-eat Mexican buffets. Whatever your culinary vision, they'll help find the right flavor of coverage for you.

What Is Restaurant Insurance?

In short, restaurant insurance is a policy designed to cover all the components involved in your restaurant, from your property and supplies to your employees and customers. Obviously, serving food to the public ties directly into concerns about protecting their health, but restaurant operation comes with many different risks that are important to consider before setting up shop.

What Type of Restaurant Insurance Do I Need in Alaska?

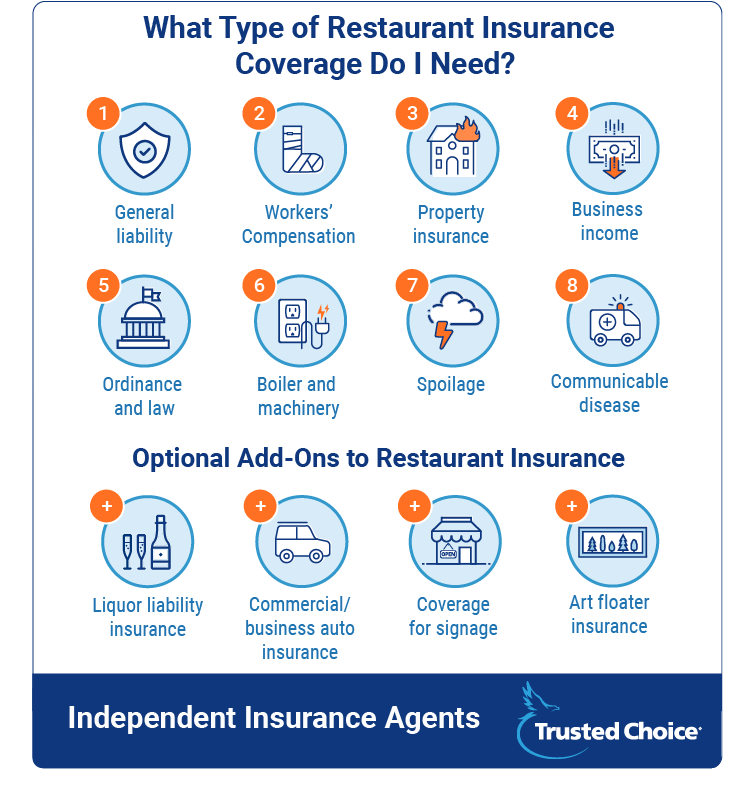

First, we're going to outline the coverage that all US restaurant owners need. A typical restaurant insurance policy looks a lot like this:

- General liability: This protects against lawsuits related to injury or property damage done by the business, and it's mandatory. Food poisoning claims would fall under this category.

- Workers' compensation: If your employees become ill, get injured or die from a work-related incident, this aspect of the insurance will cover the financial ramifications. Coverage is mandatory in Alaska, as well as most other states.

- Property insurance: This covers any damage to the physical building that houses your restaurant, in case of fire, etc. The type of cooking equipment your establishment uses will contribute to the risk of fire damage, and may influence the cost of your policy. Businesses with deep fryers that use grease, for example, are considered a higher risk.

Note: Restaurants with a drive-thru will have extra property that needs coverage, and paved surfaces (like driveways) are not typically covered by general property insurance. - Business income: A part of property insurance, this aspect covers the financial loss suffered while a business is closed due to fire damage or other disasters.

- Ordinance and law: Another part of property insurance. This covers the financial ramifications if your building is found to not be up to current state code. This coverage also applies in the event that you need to rebuild your restaurant, or if you're building one from the ground up, yourself. Handicap compliant features, fire safety equipment, and emergency exits are all factors, here.

- Boiler & machinery: Also known as "equipment insurance," it covers electric equipment in the building (e.g., AC units and boilers) that breaks down due to power surges, etc. Property insurance MAY cover this stuff, but not always.

- Spoilage: This takes care of the replacement costs of food that spoils due to power outages caused by storms, surges, etc.

- Communicable disease: Covers any illnesses transmitted to customers due to improper hygiene of your employees.

Optional Add-Ons to Restaurant Insurance in Alaska

Understanding what's included in a typical restaurant insurance policy is important, but truth be told, the standard package may not meet all of your unique needs. Your independent insurance agent can help you to identify gray areas where you might need additional coverage. Until then, however, we'll take a look at some of the most common add-ons:

- Commercial/business auto insurance: If you run a carry-out restaurant that makes deliveries, you'll want to look into getting coverage for your company vehicles for things like theft and vandalism. Your restaurant will also be held responsible for damage done by your driver while in a company vehicle. Food trucks will also need this coverage.

- Coverage for signage: This protects your signage from things like weather and vandalism, since it's not typically covered under regular property insurance. It's especially important for restaurants with a drive-thru, with all the extra signage that could be damaged due to distracted or impaired drivers, or vandalism.

- Art floater insurance: This option exists mainly for the bigger/fancier restaurants with artwork on display. Scheduling an appraisal for the specific pieces you want to cover is the first required step. In case of fire or even theft, this coverage can help prevent having to pay for the replacements out of pocket.

- Liquor liability insurance: While not mandatory, this coverage can fill in some important gaps. General liability will NOT protect you if your employees overserve a customer who ends up with a DUI or other alcohol-related charge. Coverage is more necessary for smaller restaurants, as chains tend to have stricter serving rules and training policies in place to prevent mishaps.

How Do Alaska's Dram Shop Laws Influence My Coverage Needs?

Dram shop laws hold a business liable for serving alcohol to minors, as well as for harm caused by an individual who has been overserved by that business — even after they leave your establishment. A state's specific laws and set of associated penalties/fines for violating them can influence your liquor liability coverage needs and the cost of your coverage.

In Alaska, as well as most other states, a guest who sustains injuries to themselves due to over intoxication may not sue the establishment, since it's considered the guest's personal responsibility to monitor how much they consume. So, liability coverage for first-party cases is mainly only required in the case that a minor is served, because minors are not legally allowed to drink in any state.

However, third-party liability coverage is crucial. In the case that another individual is harmed by an intoxicated guest, such as in a bar fight or auto accident, they may sue your establishment. For these cases, the third party will need proof that the intoxicated guest continued to be intentionally served past the point of visible intoxication by your restaurant.

Lawsuits can seriously cost you or your business, in the form of significant financial penalties, loss of employment or liquor license, or even jail sentences. Your agent will set you up with the proper liquor liability coverage based on Alaska's unique laws. They'll also explain the costs associated with each level of coverage.

Make Sure Your Restaurant Has Wildfire Coverage in Alaska

Alaska's most common natural disasters are actually wildfires. In fact, in 2015 alone, more than 700 fires plagued the state. That being said, it's imperative to make sure that your restaurant insurance package includes coverage for wildfires.

Ask your agent to double-check your policy to make sure that it lists wildfire protection, specifically. You'll want to be 101.2% certain you've got coverage in place from the start, to keep things from getting too hot to handle.

How Much Does Restaurant Insurance Cost in Alaska?

It depends on what kind of restaurant you run and a few other factors, such as if you've got employees, offer a delivery service, operate a drive-thru or serve liquor. However, a typical range for coverage starts on the low end of about $10,000/year for a smaller establishment with fewer employees and hits the high end of more than $100,000/year for a much larger restaurant, like a chain.

A restaurant insurance policy is typically the cheapest and easiest way to go. This package offers most of the liability and property coverage you'll need, and you can always add on specifics as necessary. Your independent insurance agent will know exactly what to hook you up with.

What's the Safest/Cheapest Kind of Restaurant I Can Start?

Obviously, smaller is going to be cheaper. A food truck or corner stand downtown will be by far the cheapest option since there won't be as many sales as in a larger chain, there aren't any other employees (that would require workers' comp), and you won't be serving alcohol. Coverage costs would most likely be in the low thousands each year.

What's the Most Expensive/Riskiest Kind of Restaurant I Can Start?

On the other end of the spectrum, a large dine-in chain restaurant with lots of employees, features like a salad bar and buffet, and a liquor bar is by far the priciest/riskiest venture. All the required workers' comp, property and liability insurance drive up costs exponentially. It ultimately depends on lots of specifics like the number of employees and the value of the property, of course, but we're talking BIG numbers, like more than $100,000 per year.

What's So Great About an Independent Insurance Agent?

Insurance policies are often filled with lots of technical jargon. Additionally, it's a real process to hunt for the RIGHT policy. Fortunately, sifting through the available options and pinpointing the necessary coverage is a task that can easily be handed off to someone else. That's where independent insurance agents come in to save the day.

Independent insurance agents will not only help you get the best possible deal, but also the type of coverage that's right for you (and only you). They shop and compare insurance quotes for you, and even break down all that jargon into the language YOU speak, so you know exactly what you're getting.

ncsl.org

servsafe.com

dui.findlaw.com

alcohol.org

Alaska Interagency Coordination Center