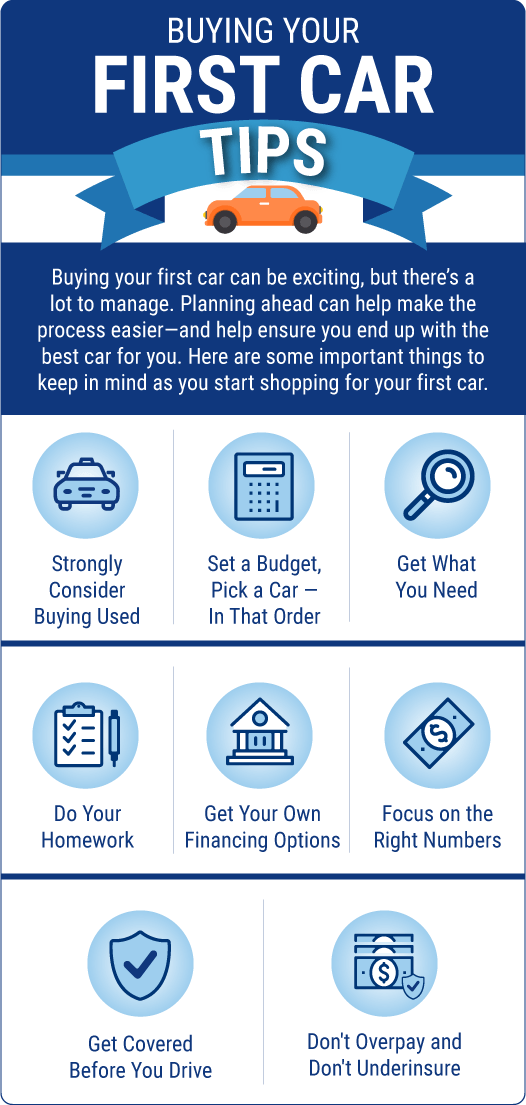

8 Tips for Buying Your First Car

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

Whether you’ve been using public transportation or borrowing a vehicle from mom and dad, buying your own car is often a rite of passage as much as it can be a daunting task. You’ll need to consider things like engine size, safety ratings, and other car features before choosing the right vehicle. Even more importantly, you’ll need to create and stick to a realistic budget.

You also need the right car insurance to accompany your new car. Knowing what kind of auto insurance you need and how much it costs is essential to your search. A local independent insurance agent can help you find affordable car insurance with quotes from multiple auto insurance companies. But first, check out our guide of essential tips for buying your first car.

1. Consider Buying Used

Used cars often make the best first cars. First, you’ve probably heard the old saying that a new car depreciates the minute you drive it off the lot, and that’s not necessarily an exaggeration. New car depreciation varies by make, model, maintenance, and other factors, but on average, new cars depreciate by as much as 20% (or even more) in the first year and around 60% after five years.

If you take out a loan to buy your new car, depreciation means that very quickly, you’ll owe more than it’s worth. That’s not good if you need to offload it later, only to find you owe more than any buyer will pay.

With a used car, you're paying for a vehicle that has already undergone arbitrary depreciation. This means you won't pay an inflated price just for that "new car smell." These factors make used car dealerships a great option for first-time car buyers.

2. Set Your Budget Before You Pick a Car

Setting a realistic budget is the first and likely most crucial part of the car-buying process. Overextending yourself might just cost you more money and stress in the long run, so keep your expectations based on real-life calculations of what you can and can’t afford.

Figuring out your budget will also make the process easier. Once you have a number in mind, you can narrow your search down to the models that fit.

Consider that budgeting for car ownership isn't just about meeting the monthly car payment. There are other associated costs, too.

Here's a simple way to budget for all of the costs of owning a car:

- Calculate your basic cost of living: This includes your rent or mortgage, food, health insurance, and other essential monthly spending, like internet, cable TV/streaming services, or takeout meals.

- Calculate what's left: What remains after your basic cost of living is covered is what you can spend on your car payment, insurance, gas, and maintenance costs. Whatever remains is what you can afford to spend on the car payment itself.

Other ways to make your car purchase more affordable

Setting a budget before you buy your first car is a critical step that you shouldn't skip. Additionally, there are other ways to lower the cost of your first car when you're on a budget, including:

- Reducing your monthly car payments by putting more down upfront

- Finding a car from a private seller or classified ad, since you might be able to pay cash and eliminate a monthly payment

- Buying a car that needs some work if you or someone you know looks at it and knows how to fix it

Without an appropriate budget, you could be setting yourself up for needless financial difficulty after you purchase your first car. Take the time to complete this critical step to help set yourself up for success.

3. Understand Needs vs. Wants

Once you know your price range for financing or a cash purchase, you can evaluate your needs. These are the features your first car absolutely must have. Remember that your needs should always be kept separate from your wants, and your needs should come first. You may need your first car to have the following characteristics:

- Great gas mileage

- Room for extra passengers or cargo

- All-wheel drive for snowy winters

- Extra airbags

Write these needs on your list and then stick to them as you research and shop for your first car. Your first vehicle may not have all the bells and whistles of your ultimate dream car, but it should at least check off everything on your needs list.

4. Do Your Homework

Research is critical for a first-time car buyer. With so much information at your fingertips today, particularly on the internet, it’s easier than ever to get the information you need. Be sure to use all the resources at your disposal so you aren't unpleasantly surprised down the road.

There are many places to learn about your options, such as:

- National Automobile Dealers Association (NADA) Guides: These and other publications, like Kelley Blue Book, can help you learn about various car makes, models, and model years. These resources can help you figure out how much your first car will cost and much more.

- Online reviews and auto repair forums: These can help you find all kinds of information and anecdotes from real people on the cars and trucks you like best.

- Existing owners of vehicles you like: They can tell you what parts break first, how the car rides, and whether that too-good-to-be-true gas mileage number really stacks up to daily use.

Don’t forget the most important research method of all: the test drive. A thorough test drive will take you down bumpy back streets and involve high freeway speeds to get a feel for the car’s capabilities and see if it’s a good fit for you. Don’t feel pressured to hurry through this step. Take the time you need to get it right.

5. Check Out First-Time Car Buyer Programs for Buyers With No Credit History

A first-time car buyer program offers loans to those with little to no credit history. This type of first-time car buyer financing can be beneficial if you've never had to take out a loan before or haven't had to pay for things like utilities or other expenses.

Where to get a first-time car buyer loan:

- Credit unions

- Captive lenders (the financing arm of an automaker)

- Marketplace lenders, who work with a network of lenders so they can match first-time car buyers to an appropriate lender

- Online car retailers (e.g., Carvana, CarMax, Vroom)

While first-time car buyers are often considered young adults ages 18-24, eligibility for these loans isn’t always based on age. Lenders typically categorize first-time car buyers as those with limited or no credit history and no previous auto loan, regardless of age.

6. Focus on the Right Numbers

Instead of focusing on a monthly dollar amount when negotiating your car purchase, stick to the total price. If you're willing to pay $8,000 for the car, stick to $8,000 in the negotiation, plus taxes, title, and registration. If the car lists for $9,000, you can try to talk the price down to $8,000 or go elsewhere. If it lists for $8,000, try to get taxes and fees included in the price.

Never tell a salesperson how much you plan to pay monthly for your first car. If you do, they may manipulate the cost of a vehicle that's out of your price range to fit your budget. Salespeople can do this by:

- Adjusting the interest rate

- Offering you a longer term on the loan

- Restructuring the financing in a way that creates a payment that fits your budget

So, while you can technically "afford" it now, it can ultimately add thousands of dollars and years of extra payments on your first car loan. It also helps to bring an experienced friend along to give you moral support, especially someone who’s purchased several cars before. If you know someone who also has connections to mechanics and can look under the hood for you before you buy, it can make purchasing your first car that much easier.

7. Get Car Insurance Before You Drive

According to your state law, you'll likely need a certain amount of car insurance. Have a plan for car insurance, and make sure you’re covered when you drive the car off the lot. It's critical to get set up with the right amount of car insurance in your state.

Because you’re a first-time car buyer, you might not get the cheapest rates around, but an independent insurance agent in your area can make sure you get the best coverage for your needs and budget.

8. Don't Overpay or Underinsure

Most states have minimum requirements for liability coverage. Car insurance pays for injuries or damage you might cause to other people and their property. Your auto liability minimum requirements might look like this:

- $25,000 per person per accident

- $50,000 per accident in total

- $20,000 for property damage

Your policy will list these amounts as 25/50/20. While $50,000 per accident might sound like a lot of coverage, it can add up to very little, depending on the vehicles, people, and other factors involved. You'll have to pay the difference if the accident costs more than your coverage.

If you have no assets for a court to use to pay your debt, the injured person can go after your future earnings for an indefinite length of time until that debt is paid. So, get as much liability coverage as you can afford.

If you’re financing your car with the dealership or a credit union, you'll also need collision coverage and comprehensive coverage in most cases. Collision coverage pays for physical damage to your car after an accident, while comprehensive coverage can pay for damage caused by threats other than collision, including windshield breaks, hail damage, vandalism, and more.

9. (Bonus Tip) Work with an Independent Insurance Agent

Getting a quick online quote from a big insurance company may seem easy, but in the end, you may not get the best rates and the quality service you deserve. On the other hand, an independent insurance agent can compare many different car insurance policies and prices to find the one that offers you the most coverage for the best price.

Independent agents are there to help you find the right coverage, and they’ll be there for you for the long haul, too. They can help you adjust your coverage over time as your needs change. And if you unfortunately have to file a car insurance claim, they can walk you through that process.

https://www.nerdwallet.com/best/loans/auto-loans/first-time-car-buyer-loan

https://www.lendingtree.com/auto/how-much-do-new-cars-depreciate/