If My Tennessee Basement Floods Due to Improper Building, Who's Responsible?

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Even if you think your brand-new house was constructed perfectly, you might still end up with a shocking disaster on your hands. Industry estimates show that 14,000 Americans deal with a home or work water damage emergency every single day. Even worse, it's estimated that 98% of all US basements will suffer water damage at some point.

These stats just provide more incentive to get in touch with a Tennessee independent insurance agent and get set up with the right kind of homeowners insurance ASAP. They'll help you get covered against unexpected water damage and much more. But for starters, here's a breakdown of who's really responsible for water damage in a brand-new home in Tennessee.

Who’s Responsible for Flooding Damage to a Brand-New Home?

According to insurance expert Jeffery Green, homeowners insurance will only cover flooding under limited circumstances like a broken pipe or washing machine hose, regardless of whether the home is new or not. Faulty workmanship is not covered. If the new home came with a warranty, that would be the first place to look if your basement had flooding damage.

Am I Responsible for Covering Any of the Damage?

Unfortunately, homeowners insurance does not cover faulty workmanship. If your home did not come with a warranty or the builder's coverage didn't pay for the damage, you'd be on the hook for covering the damage yourself. Further, if the leak occurred due to your own negligence, you might not be able to get the repairs covered by your home insurance, and you'd be on the hook for all costs then as well.

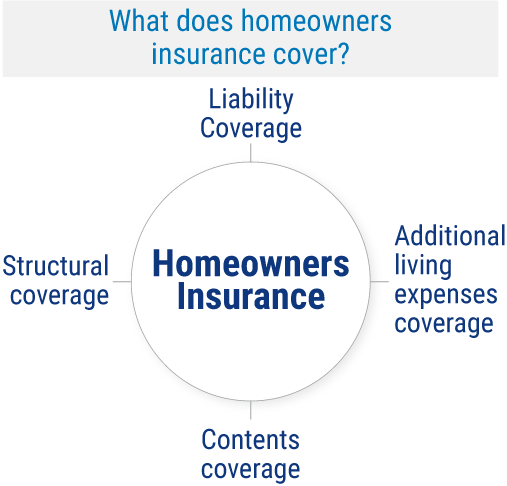

What Does Homeowners Insurance Cover in Tennessee?

Home insurance policies in Tennessee come with the standard core coverages provided everywhere across the nation, which are:

- Contents coverage: Offers reimbursement for damage or destruction of your possessions like clothing, silverware, furniture, etc. after disasters like fire, theft, etc.

- Structural coverage: Offers reimbursement for repairs or building of your home’s structure after disasters like lightning, hail, fire, vandalism, falling objects, etc.

- Liability coverage: Offers reimbursement for costs related to lawsuits filed by third parties for claims of bodily injury or personal property damage caused by you or your property.

- Additional living expenses coverage: Offers reimbursement for extra expenses like hotel rooms, additional gas mileage, takeout meals, etc. if you can't live at your home while it's being repaired after a covered disaster.

A Tennessee independent insurance agent can get you set up with a homeowners insurance policy that provides all the major coverages you need.

What's Not Covered by Home Insurance Policies in Tennessee?

As with any other type of policy, your Tennessee homeowners insurance comes with a specific set of perils it doesn't cover. Common home insurance exclusions are:

- Intentional or malicious acts against others

- Insect or pest damage or infestation

- Routine maintenance costs and general wear and tear of the home

- Failure of the homeowner to maintain the home

- Natural flood and earthquake damage

- Damage caused by war and nuclear fallout

Ask your independent insurance agent in Tennessee about adding flood insurance or earthquake insurance if you're concerned about these natural disasters which are excluded by home insurance.

Will My Home Insurance Rates Be Affected if I’m Not Responsible for the Incident?

Your insurance carrier may increase your rates after you've filed a claim, no matter the cause of the incident, but not always. You may even lose a claims-free discount you had on your policy beforehand. Unfortunately, this can still be the case even if the cause of the damage to your home wasn't technically your fault.

What Kind of Insurance Coverage Does the Builder/Contractor Have?

Your home's builder or contractor needs to have their own coverage, which often comes in the form of contractor insurance. These policies often include the following:

- Property coverage: Contractors need coverage for their business's property and equipment used for the work they perform against many types of disasters, including fire and theft.

- Liability coverage: Contractors need protection against lawsuits for improperly executed work and other claims, like bodily injury or property damage. Contractors may need both general liability coverage and professional liability coverage as a result.

- Workers' compensation: Contractors need protection for their employees or crew against injury or illness or even death caused by job duties or the work site.

- Commercial vehicle coverage: Contractors need special protection for company vehicles against all kinds of threats.

If you ever need to hire a contractor, be sure to ask for proof of their insurance at the beginning. Your contractor must carry at least liability coverage in case there's an issue with the work they perform, so you can properly collect compensation if necessary.

What Are the Long-Term Consequences if the Flooding Isn’t Repaired Immediately?

Not cleaning up an incident of flooding in your home can have long-term consequences if you don't tend to it right away. Just a few of these can be:

- Structural damage that occurs from water sitting in one spot for too long

- Mold and mildew growth, which can lead to health problems and foul odors in the home

- Stains on your ceilings or walls that indicate a leakage of water

- Increased water bill expenses if your plumbing is leaking

- Indications of a larger problem that hasn't yet been addressed

Dealing with a water problem in your home immediately can help you avoid potential further complications and expenses. Also, always make sure to routinely review your home insurance coverage with your Tennessee independent insurance agent just in case of a home disaster.

Why Choose a Tennessee Independent Insurance Agent?

Tennessee independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll cut through the jargon and clarify the fine print so you'll know exactly what you’re getting.

Tennessee independent insurance agents also have access to multiple insurance companies, ultimately finding you the best home insurance coverage, accessibility, and competitive pricing while working for you.

https://www.waterdamagedefense.com/pages/water-damage-by-the-numbers#:~:text=According%20to%20industry%20estimates%2C%2014%2C000,water%20damage%20during%20their%20lifetime