What’s So Great about Independent Insurance Agents?

Part of what makes a business efficient and profitable is the art of delegation—leaving certain tasks and operations to those who can do them best. So when it comes to protecting your company’s property and liability interests, you just can’t beat having the right insurance guy in your corner to handle getting you the right coverage for your business.

For that kind of peace of mind, we say you can’t go wrong with an independent insurance agent. But what exactly does “independent” mean? For starters, there are three basic types of insurance agents out there:

- Captive (or direct writer) agents: These are great if all you care about is a company with good name recognition (like Allstate, State Farm, Farmers, American Family, etc.). Captive agents buy a franchise and use their systems, sales materials, and only their products — which means your company’s options are pretty slim.

- Online agents: Like captive agents, online agents also only sell one carrier’s policies. But instead of being sold through a franchised location, they’re sold online and over the phone through a call center located just south of “Whoknowswhere.” Without a lot of overhead, these agents may be able to give your company some super-cheap insurance, but it typically comes with significant sacrifices in your coverage.

- Independent agents: a.k.a. brokers, independent agents are like a super combo of both captive and online agents. Similar to captives, you meet with them face to face to walk through your company’s needs, but they aren’t just tied to one specific company, which gives you way more options for coverage. And like online agents, they can usually help save you a bunch of money since they get to shop around for the right deal — at no sacrifice in your business’s coverage.

There are benefits to all three, but we’re firm believers that when it comes to properly protecting your company’s risks, the perks of independent insurance agents are second to none.

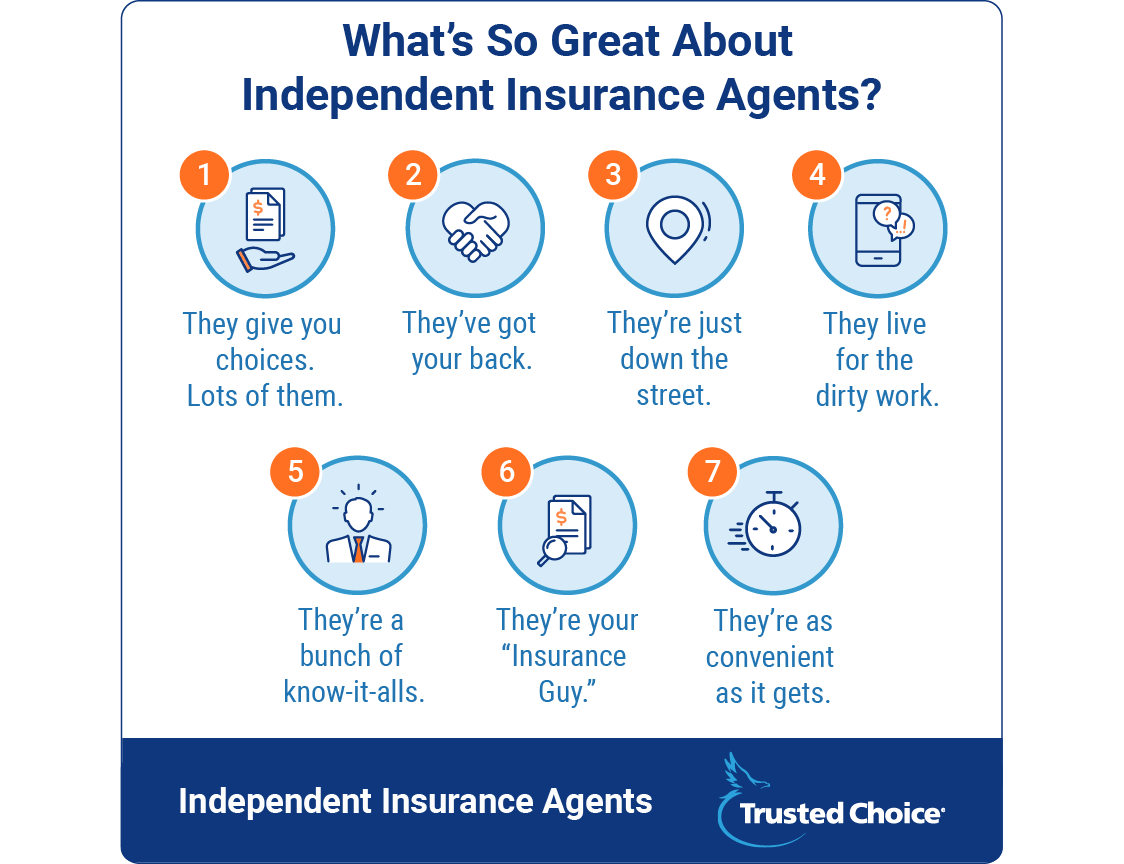

Want More Reasons? You Got ‘em.

1. They give you choices. Lots of them.

As we said, the "independent" in independent insurance agent means they’re free to provide insurance products from all sorts of different providers. And with a bigger playing field, they can help you find a policy that matches all of your business needs, at the perfect price.

2. They’ve got your back.

Independent insurance agents work for you, not the insurance company. They want your business and all of its risks to have the coverage needed, and not an ounce more. And if there are discounts available that might help lower your premiums, they’ll find them for you. Because independent insurance agents sit and listen to all of your business needs and goals, to help find the perfect protection for you.

3. They’re just down the street.

With a local independent insurance agent, you get someone who’s just a quick phone call away and knows exactly what you need. If your business needs change suddenly, getting hold of your agent is as easy as it gets. Plus, they’ve been through this all before many, many times over and know all about any state-specific requirements, general insider details, and so on. You just can’t beat that.

4. They live for dirty work.

No one likes dealing with the insurance companies when it comes to filing claims and dealing with billing issues. But with an independent insurance agent, you’ve got someone who will handle it all for you. They’ll fight your fights, handle all the nitty-gritty, and let you get back to business as usual.

5. They’re real know-it-alls.

When you’re looking for the right coverage for your business, it’s important to have someone who knows what they’re doing. After all, insurance can be confusing, packed with intimidating legal terms and fine print.

But an independent agent will help walk you through it all, so that in the end, you understand your insurance policy just as well as they do. Because the better you understand it, the better it will help protect your company.

6. They’re your “Insurance Guy.”

Independent agents don’t just disappear once you’ve got your policy in hand. They’ll periodically review your business’s coverage and reach out with any suggestions that might protect you better or save you money as time goes on.

And unlike captive and online agents, if you want to switch insurance carriers for a better price or coverage, your independent agent can go with you. And they already know all your company ins and outs.

7. They’re as convenient as it gets.

Your company’s time is valuable. So why waste it talking to this agent about property coverage, and that agent over there about workers' comp? With an independent insurance agent, you get a one-stop shop — and that means you get all the insurance you need in one place. Property, liability, workers' comp, or whatever.

So, How Do You Find Independent Insurance Agents?

Good news is, it’s easy. A quick stop at TrustedChoice.com will put you right where you need to be to get started. Just answer a few quick questions and a massive database featuring over 250,000 independent insurance agents will set you up with recommendations based on your company’s needs and location. Then you’ll contact any, or all, of the agents referred to you and they’ll take it from there. See, super easy.

Meet Your Match.

When you’re looking for insurance to cover your business, having the right agent in your corner is key. And while there are benefits to both captive agents and online agents, you just can’t beat the personal touch, the options, and the price that comes with an independent insurance agent. Good luck, and happy hunting.