How to Choose an Insurance Agent

Candace Jenkins is a licensed insurance advisor with over a decade of experience. She is also a writer and loves to write on all things insurance. Candace writes for TrustedChoice.com on a continuous basis and is here with the facts about all your insurance inquiries.

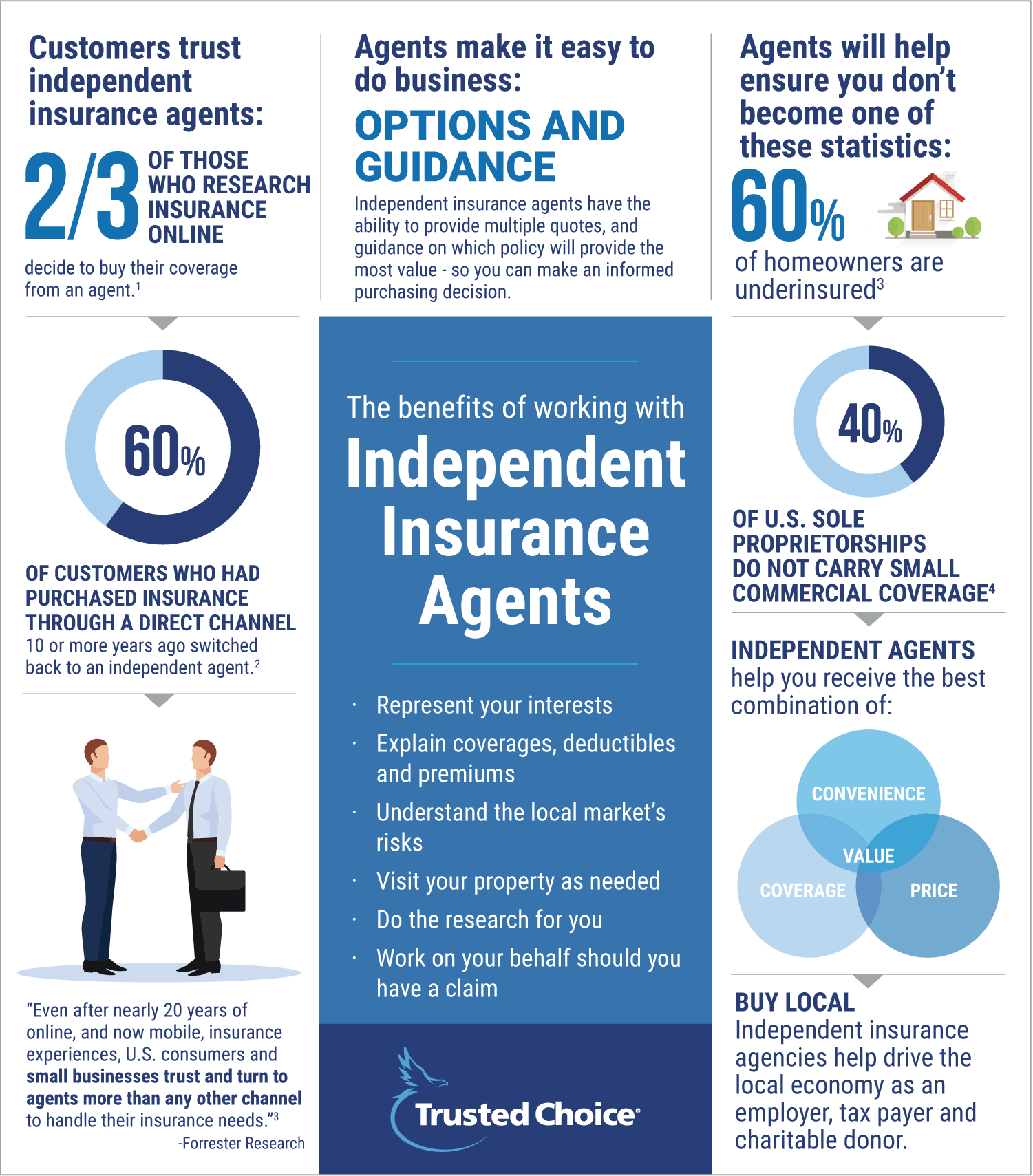

There are several options when it comes to choosing the right insurance agent for yourself. The benefits of having an independent insurance agent in your corner are too significant not to note.

At TrustedChoice.com, you will be able to search through free resources and even get matched with a local independent agent.

The Independent Insurance Agent

In insurance, there are a few options when it comes to picking your agent type. There is also a sea of agents in each category. It may be hard to know which is best for you and your specific needs.

What is great about an independent insurance agent is that they have choices. They can work with several different insurance carriers and give you more options on price and coverage. And as a bonus, they work for you, all without paying them a dime. Does it sound too good to be true? Well it's not, and reading on will prove it to you.

The Different Agent Types

As you may have gathered, there are choices when it comes to choosing an agent. It's a good idea to know what you are getting with each one and how they are different.

| The Independent Agent: |

| The independent insurance agent has the most flexibility when it comes to coverage, carriers, and rates. With the ability to produce dozens of carrier offerings, they can find you the best premiums without sacrificing coverage. |

| The Captive Agent: |

| The captive agent differs from others because they work for one carrier. This means their coverage and price offers take a hit due to a lack of options. If your premiums increase with a captive agent, there is little they can do to find you better pricing. |

| The Direct Writer: |

| If you go with a direct writer, you are going directly to the insurance company. This cuts out the middle man, aka the agent, but also cuts out valuable advice on coverage, options, and customer service. Some may want a quick fix to get them over the insurance buying hump, but it could bite them in the long run. |

Which Agent Should You Choose?

Choices, choices, choices. Life is full of them, and finding an insurance agent is no different. To know which agent type is right for you is your decision. However, there are reasons that people choose independent insurance agents again and again. They are the best of all insurance worlds.

Reasons to choose an independent agent

How an Independent Agent Is Always on Your Side

When it comes to insurance, you want to work with someone you trust. An independent agent's whole job is getting you to trust them. They are in it for the long haul and want to build a relationship that will last for years.

You see, an independent agent is not just about a quick sale. They walk with you through some of life's toughest moments. And their business model is retaining clients over long periods. That is why they have the most options, best pricing, and the ability to shop your coverage all from their keyboard.

Best of all, the independent agent works for you, not the insurance company. They are indeed on your side, saving you time, money, and a lot of hassle.

The Facts Don't Lie

You may still be on the fence when it comes to choosing your agent. Sometimes knowing the facts can help you make the best decision.

Likelihood of Consumers Finding Better Insurance Rates Without an Independent Agent

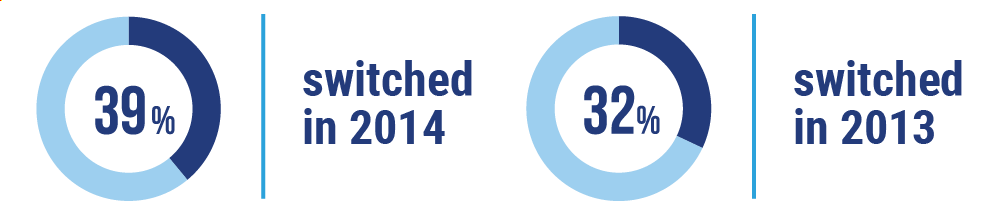

Rate hikes contribute to customers shopping for a better deal, and while more customers are shopping for a new insurer (39 percent in 2014 compared with 32 percent in 2013), fewer are switching.

The 2015 study finds that among those who shopped, only 29 percent switched in 2014, compared with 37 percent in 2013.

Sometimes rates are what makes you go on the hunt for greener pastures, but few customers are switching from their independent agent, and there's a reason.

Why People Keep Coming Back

1. US Insurance Shopping Study, J.D. Power, 2016

2. 2013 study conducted by InsightExpress and The Hanover

3. Forrester Research, Loyal Insurance Agents Drive Sales, February 2016

4. Small Commercial Insurance: A Bright Spot in the US Property-Casualty Market, McKinsey & Co, 2016

This material is provided for informational purposes only and does not provide any coverage. For coverage, please contact an independent insurance agent.

Why the Grass Isn't So Green on the Other Side

You may be a DIYer and want to explore the world of online insurance hunting. While it may be perfectly fine to DIY your bathroom tile, it's a different story when shopping insurance.

1.) If you aren't a licensed agent, you don't know what you don't know. How are you supposed to recognize what coverages cover what and how they work for your risk exposures? An agent could advise on this and would know which coverage best suits your needs.

2.) What happens when you have a claim, and your 1-800 hotline isn't so hot? Service, when it matters most, is worth every penny. It's also where your agent shines and can make a bad situation better.

3.) The price isn't king when it comes to your insurance coverage. Yes, staying within your budget is always key, however, it should not be the only factor. Sometimes better coverage is worth paying for, and an independent agent can help.

4.) You don't have to pay for your agent. The neat thing is, the insurance companies pay the agents directly, so you don't have to worry about spending extra on having one.

Navigating the icy waters of insurance policy forms and exposures isn't for everybody. Your independent agent thrives in this area and can be utilized for free.

Where Can I Find an Independent Agent?

If you've decided to work with an independent agent, finding one couldn't be easier. TrustedChoice.com has a find your agent tool that will allow you to click your way to a trusted advisor. There are plenty of them in your area, and knowing the right one will get your insurance ready for whatever life throws at it.

https://www.statista.com/study/59978/property-and-casualty-insurance-in-the-united-states-2019/