Why an Independent Insurance Agent Is Better Than Self-Insuring

Candace Jenkins is a licensed insurance advisor with over a decade of experience. She is also a writer and loves to write on all things insurance. Candace writes for TrustedChoice.com on a continuous basis and is here with the facts about all your insurance inquiries.

If you are a large company or just a single-family household, self-insuring may be something you've thought about. Before you decide on whether to go with an independent agent or self-insure, there are a few things you need to know.

TrustedChoice.com has connections to independent insurance agents in your area. They can help guide you in your decision-making process and tell you the pros and cons of each.

What Is Self-Insuring?

Self-insuring may sound scary and even foreign if you are not sure of the concept. Most of your policies would still be active when it comes to self-insurance, with your life insurance being one that some have decided to self-insure.

Of course, there are other ways to self-insure. It is all dependent on your income and how much money you can risk. When you trust your insurance to a carrier, they are essentially assuming your risk and promise to cover an exposure when a claim arises.

With self-insurance, you take the carrier out of the equation and promise yourself that you will pay the expense when something catastrophic happens. The catch is you have to have enough money to be able to cover the loss.

Most insureds can't stomach a bill for hundreds of thousands of dollars and up, so they choose to pay a premium and have the insurance company take the hit.

What Does Self-Insuring Look Like?

Self-insuring can look like several different scenarios depending on what you want to be responsible for. Some business owners decide it costs them less to have enough capital in savings and pay out of pocket for any claims that come their way. This can be tricky, and here is why:

1.) They have to assume responsibility, which means they are entirely liable for anything that happens.

2.) You never know how big a claim could get, so if you under-calculated your exposure, you could be in deep water.

3.) There are a lot of risks that need covering in business, and being sure you've got all your bases covered could be expensive.

If you are an individual and want to self-insure, it may look a bit different than a business. Depending on what you are looking to be responsible for, you could have a significant variance in what you have saved to cover a claim.

Speaking with a knowledgeable independent insurance agent can help see the pros and cons of each.

How Does Self-Insurance Work?

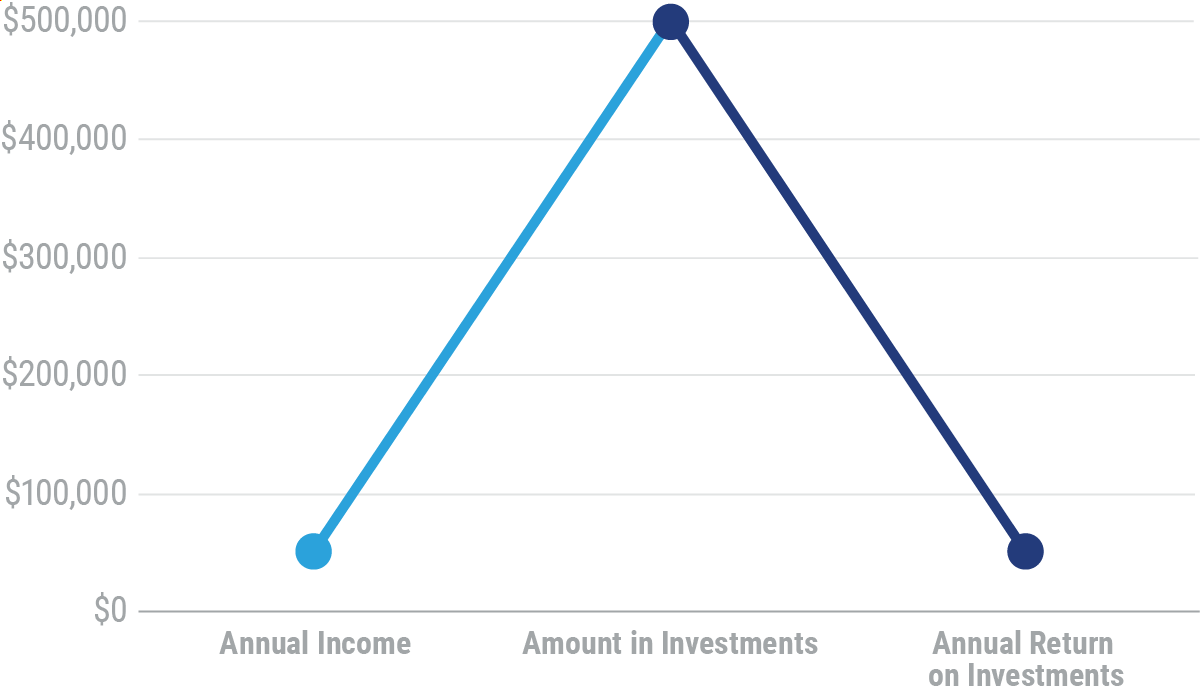

Picture this: you pull in $50,000 annual income, which means you will want to have $500,000 in investable assets so you have enough coverage. Typically, this is referring to self-insuring a life insurance policy, but you get the picture.

Scenario of What You'd Need to Self-Insure Life Insurance

What You Shouldn't Self-Insure and How an Independent Agent Can Help

Business Insurance: There are so many different exposures and people involved when you are operating a business. If you're thinking about self-insuring, don't. Most business owners do not have the cash flow to cover significant claims. This could put you out of business faster than you started.

- Instead: Speak with your independent agent on high deductibles for the small- to medium-sized claims and let the insurance company handle the rest. This will save you some premium and give you peace of mind.

Homeowners Insurance: Your home is likely your largest asset, so trusting it to self-insurance is a risk. To account for the what-ifs in life may not be a gamble you want to take. Because homeowners insurance covers so much more than just your home, it's best to leave this one up to the experts.

- Instead: Have a conversation with your independent agent about raising your deductibles and bundling all your policies to save premium.

Auto Insurance: This is definitely a policy you want your independent agent to handle. Auto insurance is probably the most volatile of them all because they have to account for a lot of other third parties. The road is a busy place, and there's no telling what can happen. A four-car pileup could cost millions when it's all said and done, and if there's a death that occurs as a result of an accident, you might as well hand over everything you own.

- Instead: Speak with your independent agent about raising deductibles and changing coverage that may not be needed on older vehicles.

Life Insurance: This is the policy that most people don't actually own, and if they do, it's usually not enough coverage. Life insurance will cover the financial burden that comes after your passing. If you have a good policy in place, you will be able to pay all funeral costs and assets off and even leave something to your loved ones. This is the insurance that most people want to self-insure. But unless you have ten times your income saved up, it's probably better to let your independent agent handle it.

- Instead: Make a plan with your independent agent on some life insurance products that have a death benefit for when you pass and a growing mechanism to utilize the tax benefits.

Why You Need an Independent Agent

If you have an independent insurance agent in your corner, you can talk through self-insuring ups and downs. Your agent will give you unbiased advice and steer you in the direction that's best for you.

Life can be risky, and it's best to have an expert opinion so you know what you're getting into and how to handle it best.

Where Do I Find an Independent Insurance Agent?

TrustedChoice.com is your one-stop resource when it comes to insurance coverage and finding a local agent. They have connections and the know-how to use them. With the find an independent agent tool, it's as easy as 1-2-3.