Rebuilding After the 2011 Super Tornadoes

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Insurance provides important coverage for huge catastrophes of all kinds, even devastating natural disasters. When the Tornado Super Outbreak struck in 2011, it cost billions of dollars in damage and hundreds of deaths. Fortunately, coverages like property insurance were able to help victims get back to their lives. If insurance can rebuild after a disaster like this, imagine what the right coverage can do for you.

An independent insurance agent can help you find the best protection for your own disasters, even if they’re not quite as tragic as this one. But first, here’s a closer look at the Tornado Super Outbreak and all the ways insurance was able to help victims recover.

What Was the Impact of the Tornado Super Outbreak?

The four-day span between April 25 and 28, 2011, brought one of the worst tornado outbreaks in the nation’s history. Nicknamed the Tornado Super Outbreak, this catastrophe was the costliest tornado outbreak ever to hit the US. The states hit hardest by the storms were Alabama, Georgia, Mississippi, and Tennessee. However, tornadoes were also sighted much further north, all the way up to New York.

Quick stats about the Tornado Super Outbreak:

- 321 deaths were reported

- 2,775 injuries were reported

- $12 billion in total damage was reported

- Nearly 350 tornadoes total hit the US in less than a week

- Four of the tornadoes were categorized as EF5, the deadliest ranking

- Debris was found more than 200 miles from its original location

- More than a dozen states were hit

- Some of the individual tornadoes’ paths stretched nearly 400 miles long

- A total of 3,200 path miles were reported from all the tornadoes combined

- The Super Outbreak had by far the greatest number of path miles of any outbreaks in US history

- The cumulative tornado paths could have stretched across the continental US

Though the Super Outbreak was certainly a tragedy on a massive scale, fortunately the victims were able to receive financial aid and other assistance through insurance and relief efforts.

What Were the Deadliest Tornadoes in US History?

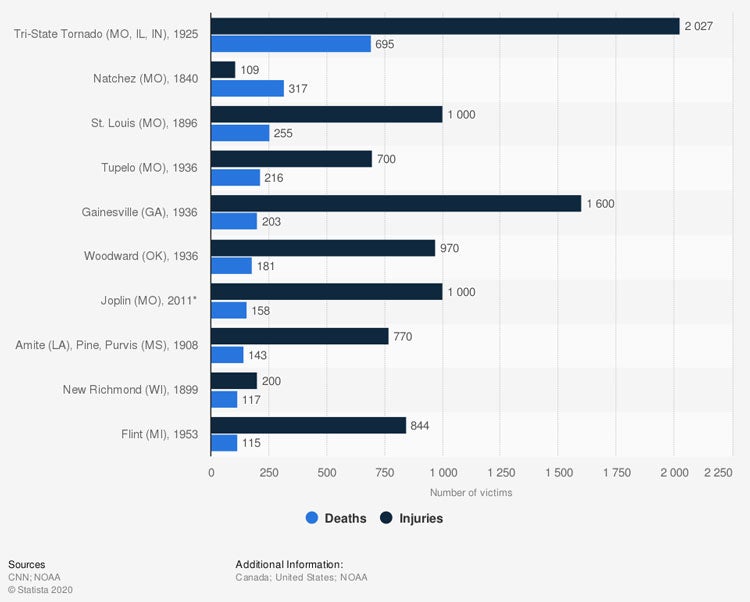

Deadliest Tornadoes in the History of the United States as of 2019, by Number of Victims

Though the Super Outbreak claimed 321 deaths and injured 2,775, the outbreak wasn’t the deadliest to ever hit the US, considering it was multiple storms combined. In 1925, the Tri-State Tornado, which affected Missouri, Illinois, and Indiana, claimed 695 lives and injured 2,027. The second-deadliest single tornado in US history struck Natchez, Missouri, in 1840, killing 317 and injuring 109 — the only tornado with more fatalities than injuries.

Who Provided Help to the Victims of the Tornado Super Outbreak?

Many agencies, including the Federal Emergency Management Agency, provided important assistance to tornado victims. Federal, local, and state agencies, as well as community groups, the private sector, and faith-based groups also greatly contributed. Federal disaster assistance for victims, in the form of grants and recovery loans, amounted to almost $257 million by late October, 2011.

Federal disaster assistance was provided to victims in Kentucky in the form of grants and loans, totaling $17.7 million. About $9 million in grants were given to victims to help them repair and replace their property, as well as find temporary housing. The Small Business Administration approved almost $6 million in loans to cover uninsured losses for victims who were homeowners, renters, and business owners.

How Did Property Insurance Help Victims Get Back to Their Lives?

Fortunately for victims of the Tornado Super Outbreak, having property insurance allowed them further assistance in resuming their lives. Property insurance helped victims of the Tornado Super Outbreak in the following ways:

- Rebuilding homes: Property insurance coverage pays to rebuild homes in the event they are destroyed by a covered peril such as a tornado. Victims of the Tornado Super Outbreak were able to rebuild homes that were destroyed by the disaster thanks to property insurance.

- Ending homelessness: Many victims of the Tornado Super Outbreak were left temporarily homeless following the storm. Fortunately, their property insurance coverage provided the financial assistance necessary to rebuild their homes.

- Replacing personal property: Victims of the Tornado Super Outbreak were largely able to replace, repair, and recover from lost, damaged, or destroyed personal belongings such as clothing, furniture, silverware, etc. following the storms. Property insurance typically covers personal property up to 50% to 70% of the insured value of the structure of the home if it’s lost/damaged/destroyed by a tornado.

- Replacing property stored elsewhere: Property insurance also covered victims’ personal belongings stored off premises, such as in storage units, following the disaster. Limits on off premises stored property are sometimes 10% of the total value of personal property coverage, but additional coverage can be added.

- Mending foliage around homes: Property coverage also includes reimbursement for foliage around the home, including trees, plants, and shrubs if they are damaged or destroyed by tornadoes. Limits typically cap at $500 per plant, but coverage amounts can be increased. Victims of the Tornado Super Outbreak were able to repair their gardens and general appearance surrounding their homes thanks to property insurance.

You may never have to submit property insurance claims for severe tornado damage, but it’s still useful to note all the relief this coverage provided to victims of the Tornado Super Outbreak, and consider how property insurance could protect you from other disasters.

Is Tornado Coverage Part of Every Homeowners Policy?

While windstorm damage coverage is often included in standard homeowners insurance policies, there are some exceptions. A total of 19 states require mandatory windstorm deductibles (for disasters such as tornadoes and hurricanes) on homeowners insurance policies, including several states impacted by the Tornado Super Outbreak. In fact, 9 of the 15 states struck by this catastrophe fall into this category.

The states of Mississippi, Alabama, Florida, Georgia, North Carolina, South Carolina, Virginia, Maryland, and New York were all hit by the Tornado Super Outbreak, and each required a mandatory windstorm insurance deductible on their homeowners insurance policies. It’s highly recommended that folks in these states add windstorm insurance on top of their homeowners coverage, and many are even required to have it by their mortgage lenders.

Windstorm insurance protects against damage due to heavy winds beyond the limit available in a standard homeowners policy. Without adequate coverage, a homeowner would have to pay for damage exceeding their policy’s limit out of their own pocket, and also to pay their deductible amount out of pocket. Talk with your independent insurance agent if you have any concerns on whether you’re adequately protected against tornado damage to your home.

How Did Car Insurance Help Victims Get Back to Their Lives?

Auto insurance also aided victims of the Tornado Super Outbreak in returning to their lives. Having auto insurance helped victims of the Tornado Super Outbreak in the following ways:

- Repairs: For victims whose cars were badly damaged by the storms, auto insurance covered repairs to their vehicles under the collision section of their policies.

- Replacement: Those victims whose cars were completely totaled by the tornadoes were able to obtain new vehicles through the help of their auto insurance.

- Rental cars: While victims awaited repairs on their vehicles, auto insurance provided them with rental cars so they could still commute to work, run errands, etc.

- Medical payments: The victims who sustained injuries during the Tornado Super Outbreak were able to be compensated by their auto insurance policy for medical payments while receiving treatment.

Though not all car insurance claims stem from damage caused by destructive tornadoes, it’s helpful to see just how auto insurance provided relief for victims of this huge tragedy in a myriad of ways. Auto insurance can also help you with many more common disasters you may face.

How Did Business Insurance Help Owners Get Back to Work?

Not all victims of the Tornado Super Outbreak were just homeowners, many were business owners as well. Luckily, business insurance provided additional coverage that allowed business owners to reopen their doors and get back to work.

Business insurance helped victims of the Tornado Super Outbreak in the following ways:

- Loss of income: Business insurance includes coverage for lost income suffered during temporary closings due to covered disasters, including tornadoes. Business owners who were victims of the Tornado Super Outbreak were able to recover lost income thanks to business insurance.

- Property repairs: Business insurance covers damage to or loss of your business’s physical property, including the structure of the building and often the inventory inside of it, due to a covered disaster like tornadoes. The Tornado Super Outbreak’s victims were able to rely on their business insurance to help them rebuild their businesses from the ground up, repair less major damages, and to recover lost property such as inventory.

- Lost employee wages: Business insurance also helps pay employee wages that are lost while a business is closed due to covered perils like tornadoes. Victims of the Tornado Super Outbreak were able to compensate their employees during long shutdowns thanks to business insurance coverage.

Businesses close for all kinds of reasons, not just due to catastrophes like the Tornado Super Outbreak. That being said, knowing all the ways business insurance provided relief to business owners following this disaster proves just how important coverage is to have for all potential disasters.

Are the States and Victims of the Tornado Super Outbreak Back to Normal Now?

Fortunately for the victims of the Tornado Super Outbreak and the many states impacted, life has largely returned to normal. Payouts from homeowners insurance allowed victims to repair or rebuild their homes and end temporary homelessness. Auto insurance allowed victims to repair/replace lost or damaged vehicles, and business insurance allowed professionals to recover lost income and wages and get back to work.

Additionally, disaster relief agencies and volunteer efforts were able to help both victims and states rebuild, repair, and replace lost or damaged property. Efforts from the many communities affected by the tornadoes were beyond admirable in helping homes and businesses to be restored. Businesses and homes across several states have been reopened and rebuilt, and as a result, victims and survivors have been able to return to life as they knew it before.

Here’s How an Independent Insurance Agent Can Help Protect You from Your Own Disasters

You’ll hopefully never encounter natural disasters as devastating as the Tornado Super Outbreak, but independent insurance agents can certainly help protect you from your own disasters. Independent insurance agents search through multiple carriers to find providers who specialize in home, auto, business, and all other forms of insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Statista

iii.org

fema.gov

ustornadoes.com

ncei.noaa.gov

weather.com