Best Voluntary Short Term Disability Insurance

(Because sometimes volunteering for benefits is the best option)

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

The thought of endless pitter-patters down the hall is calling your name, but you know that having a kid takes time and takes you away from work. You may have paid maternity leave, you may not, but are there other options for supplementing your income during your pregnancy and childbirth?

The answer is yes, and our independent insurance agents are here to tell you how. And we’re not just talking about supplementing income for childbirth. Voluntary short-term disability insurance can be used for unexpected injuries and illnesses that take you away from work. Let’s learn more.

What Is Voluntary Short-Term Disability Insurance?

Before we can understand what voluntary short-term disability insurance is, we need to understand general disability insurance.

Disability insurance is an insurance policy that will supplement your income for a specific amount of time should you be unable to work as a result of an injury or illness. There are short-term and long-term policies, and just as the name suggests, one offers benefits for a longer period.

There are also individual and group disability policies. An individual policy means you seek out a disability policy yourself, working with an independent insurance agent. A group policy means that your company offers a disability policy to its employees, usually paying a portion or all of the premium. So where does the voluntary come in?

Voluntary short-term disability insurance is the option to purchase disability insurance through your employer, through payroll deductions. It is employee-paid vs. employer-paid.

How Does Voluntary Short-Term Disability Insurance Work?

Voluntary short-term disability insurance works just like individual or group short-term disability insurance.

When you purchase this insurance, you’ll pay a monthly premium that will come directly from your paycheck. If you become ill or get injured and can no longer work, your short-term disability insurance policy will pay a percentage of your income for a specific amount of time. The average policy pays around two-thirds of your income for three to six months, but can be longer.

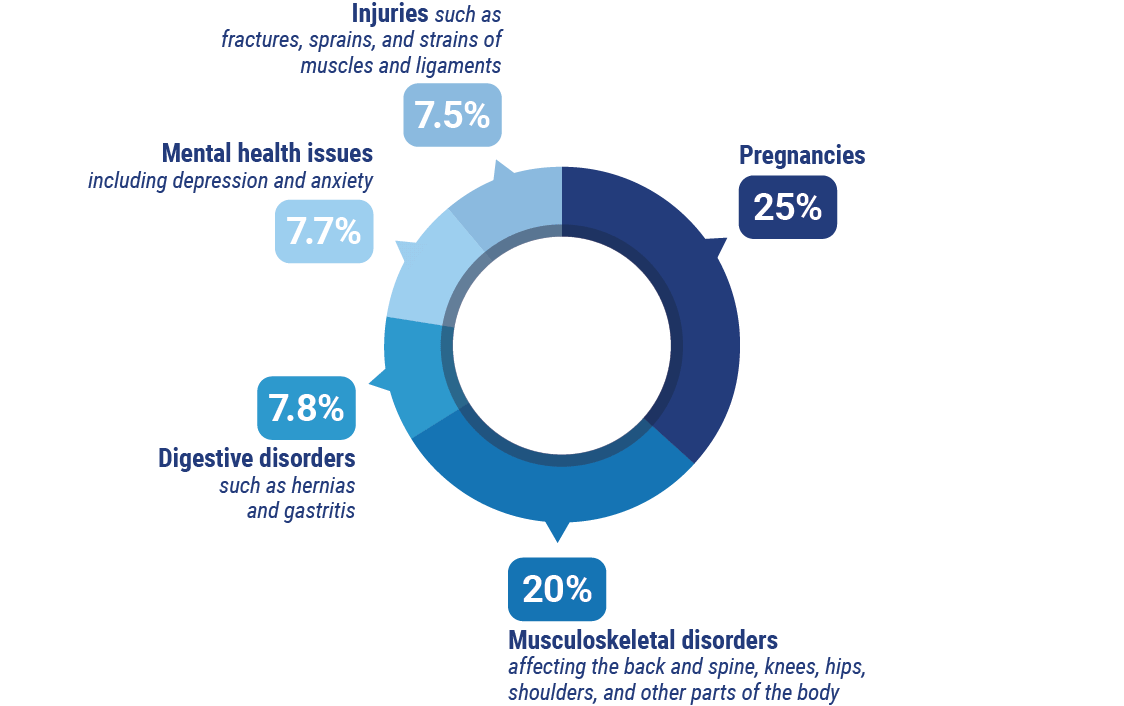

Types of short-term disabilities

- Pregnancies (25%)

- Musculoskeletal disorders affecting the back and spine, knees, hips, shoulders, and other parts of the body (20%)

- Digestive disorders, such as hernias and gastritis (7.8%)

- Mental health issues, including depression and anxiety (7.7%)

- Injuries such as fractures, sprains, and strains of the muscles and ligaments (7.5%)

If you find yourself in need of using your short-term disability insurance, you’ll be able to receive benefits after a waiting period that’s no longer than 14 days, according to the Insurance Information Institute. Based on the extent of your injuries or illness, the insurance company will determine how many days, weeks, months, or years you’ll need to collect disability benefits for.

When Would I Need Voluntary Short-Term Disability Insurance?

There are two reasons that you may need voluntary short-term disability insurance:

- Your employer doesn’t offer a short-term disability option

- The disability insurance your employer does offer isn’t enough to supplement your income should you be out of work as a result of an illness or injury.

If a company offers their employees disability insurance, there’s a good chance they pay 100% of the premium for their employees.

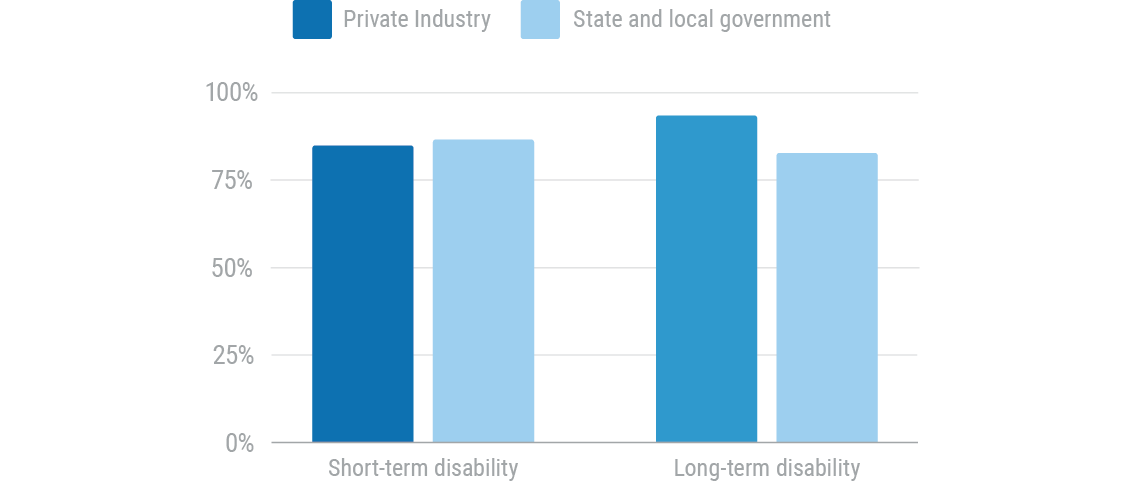

Percent of disability insurance plan participants whose employers paid the full cost of the insurance

Source: U.S. Bureau of Labor Statistics

Last year, private industry companies paid the full cost of short-term disability insurance for 85% of workers, and 94% of workers received full employer payment for long-term disability insurance.

But just because your employer offers and pays for disability insurance doesn’t mean that it fits your needs.

One of the most common reasons that individuals purchase voluntary short-term disability insurance is for childbirth. If your company doesn’t offer disability or paid maternity leave, voluntary short-term disability insurance can be a cost-effective alternative.

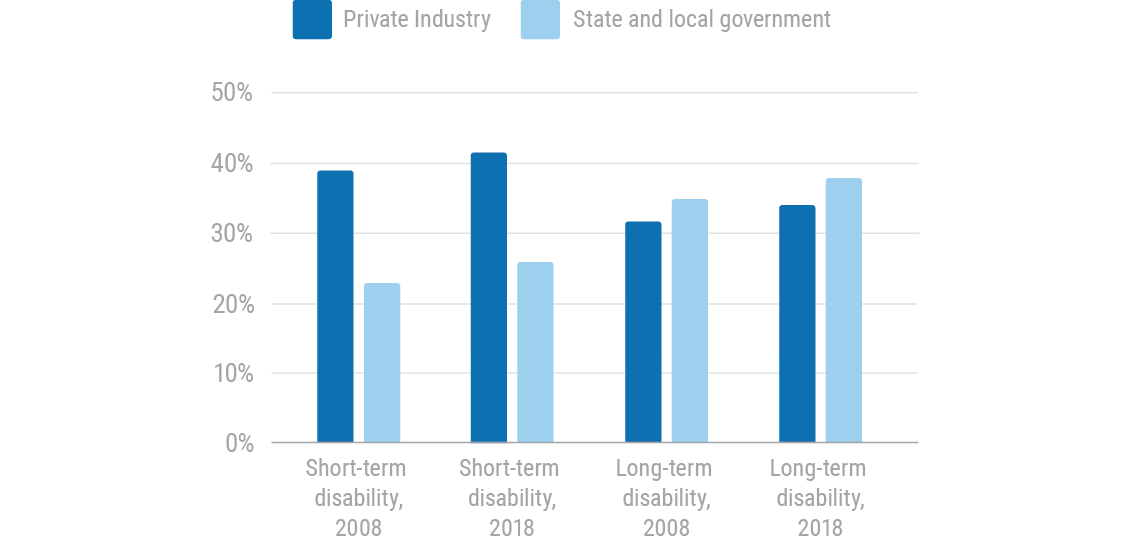

Percent of workers with access to short-term and long-term disability insurance plans

Source: U.S. Bureau of Labor Statistics

Last year, only 48% of private companies offered short-term disability insurance to their employees.

By signing up for voluntary short-term disability insurance, you can receive benefits during your pregnancy and after childbirth. The same goes for general unexpected illnesses and injuries.

What Are the Benefits of Voluntary Short-Term Disability Insurance?

Depending on your current life situation, there can be a variety of benefits to voluntary short-term disability insurance.

- You can receive a discounted premium by going through your employer vs. purchasing individual short-term disability insurance.

- You can pay your premium pre-tax or post-tax.

- Will provide coverage for normal childbirth.

- You can keep your coverage even if you get terminated from work.

- The benefits will complement workers’ compensation.

At first glance it may not sound appealing to volunteer to pay for your own disability insurance, but it can be more cost-effective than the alternative of individual insurance policies.

What Companies Offer the Best Voluntary Short-Term Disability Insurance?

Disability insurance has been around a long time, and it’s best to go with well-known companies. Our friends looked at price, options, customer service, financial standing, company history, and credit rating to determine the top ten best disability insurance companies of 2019.

- Assurity

- Guardian Life

- Illinois Mutual

- PIU (Petersen International Underwriters)

- MassMutual

- Mutual of Omaha

- Ohio National

- Principal Financial Group

- The Standard

- Ameritas

The cost of disability insurance will vary greatly depending on your age, income, and policy. On average, you can expect to pay between 1% and 3% of your income for disability insurance.

For example: If your income is $100,000 a year, you’ll pay between $1,000 and $3,000 for disability insurance.

Disability insurance is not the time to go with someone you’ve never heard of or cut corners. Well-known companies have the ability to pay out benefits and offer a variety of disability options.

Why Independent Insurance Agents?

Disability insurance policies can be complex, and searching through options can be confusing, time-consuming and frustrating. An independent insurance agent's role is to simplify the process.

They’ll make sure you get the right coverage that meets your unique needs. Not only that, they’ll break down all the jargon and explain the nitty-gritty, so you understand exactly what you're getting.

And in the unfortunate event that you need to file a claim, you won’t be alone. Your agent will be right there to help guide you through every last step so you can keep paying for your life. How great is that?

https://www.bls.gov/opub/ted/2018/mobile/employee-access-to-disability-insurance-plans.htm

https://www.iii.org/article/what-are-types-disability-insurance