Rain Insurance and Event Weather Insurance

This coverage can help you recover from financial losses if your scheduled event gets rained out or otherwise adversely affected by inclement weather.

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

Many special events can be ruined by adverse weather conditions, including heavy rain. Event organizers can protect themselves against financial losses caused by inclement weather with the right rain insurance or event weather insurance. Short-term coverage is available to protect your special events for only the duration in which you need it, making rain insurance a simple and affordable option for many event organizers.

Fortunately, an independent insurance agent can help you get set up with the right rain insurance or event weather insurance to protect your event. They'll get you matched to the policy that includes all the coverage you need. But first, here's a deep dive into rain insurance and event weather insurance, what it covers, and why it's necessary.

What Is Inclement Weather Insurance?

Inclement weather insurance, also known as rain insurance or event weather insurance, is designed to protect against lost revenue from a planned event caused by adverse weather.

Though rain is typically the most common weather threat to consider for event hosts, other types of inclement weather, such as fog, snow, lightning, deep-standing water, wind, or hail, can also lead to event cancellations and postponements. Fortunately, in most cases, inclement weather insurance protects against all of these perils.

Rain insurance can reimburse event organizers for otherwise unrecoverable financial losses, such as deposits for booking musicians or other featured entertainers, reservation fees for a venue, etc. This insurance can also reimburse you for lost ticket sales due to low attendance and other expenses related to your event.

How Does Rain Insurance or Event Weather Insurance Work?

Rain insurance or weather insurance can be purchased for both outdoor and indoor events because inclement weather can still affect indoor festivities. For example, icy road conditions can prevent attendees from getting to a scheduled indoor event.

Your rain insurance policy can provide compensation if it rains, snows, or other inclement weather conditions are present during your event's scheduled period. The event doesn't have to be canceled or postponed for your policy to cover a claim.

Events Covered by Rain Insurance and Weather Insurance

Rain insurance and inclement weather insurance can be bought to protect many types of special events. These often include:

- Fairs

- Art shows

- Weddings

- Motorsport events

- Rodeos

- Festivals

- Parades

- Movie showings

- Air shows

- Golf tournaments

- Conferences

- Concerts

- Film productions

- Trade shows

- Winter carnivals

You can buy rain insurance for a single-day, multi-day, or seasonal event, such as those that occur only during the summer.

What Is Weather Cancellation Insurance for Concerts?

Concerts are one of the most common events affected by inclement weather. Weather cancellation insurance for concerts is just a specific type of rain insurance or weather event insurance purchased for this kind of special event.

Since many concerts occur on just a single night, a single-day rain insurance or inclement weather insurance policy can be purchased to protect your concert against many types of unexpected loss in case of poor weather conditions. This coverage can reimburse concert organizers against the cost of lost deposits to book the talent for the concert, as well as for low ticket sales, food vendor deposits, security deposits, venue booking fees, and more.

Rain Insurance Coverage Options

When purchasing rain insurance or inclement weather insurance, you have several options. Here are some of the different types of coverage available to consider.

Cumulative Rainfall Coverage

This type of rain insurance gives the customer the option to choose coverage based on the total rainfall accumulation they expect might interfere with their event. Insurance customers can select an increment of rain accumulation that works best for them, such as 1/4" or 1/2" over the duration of their scheduled event. This type of coverage applies to total accumulation regardless of how many times rain occurs during the selected time period.

Rain-Free or Dry Hours

This type of rain insurance gives the customer the option to choose how much coverage they want based on "dry hours" or "rain-free hours," meaning a time period in which no rain accumulation occurred during the event.

The insurance customer can select specific hours in which they expect rain or other inclement weather to occur. Coverage will pay out compensation if inclement weather occurs during the expected hours.

Other Perils

This type of inclement weather insurance provides broader coverage than rain insurance as it includes protection against losses caused by lightning, fog, snow, extreme temperatures, tornadoes, hurricanes, and high winds. Policies can also cover events adversely affected by multiple types of inclement weather.

Other Options

You can often buy event weather insurance with special options tailored to meet your specific needs. Many insurance companies offer options for weather policies that consider a lack of inclement weather like rain or snow, which may help you save money on your coverage.

How Is Weather Monitored to Establish a Claim?

Understanding how weather is monitored can help you better understand when and how your rain insurance will pay out a covered claim.

Your event weather insurance company may use data from a national weather station to determine what type of inclement weather occurred during your event. An independent weather observer may also be used.

Finally, insurance companies may rely on experts at a local weather command to determine how much inclement weather occurred during an insured customer's event.

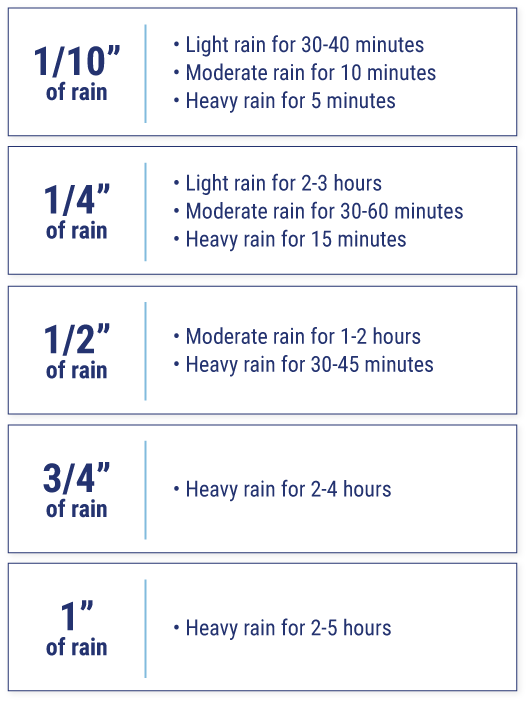

Rain accumulation per day needed to trigger a claim during covered hours

How Much Does Rain Insurance Cost?

The cost of rain insurance or event weather insurance can vary considerably depending on how long you need coverage. However, you can typically expect coverage costs to range from 2-10% of the cost of the event you're insuring.

For example, if you need a total of $50,000 of coverage, your rain insurance policy will likely cost between $1,000 and $5,000. Other factors that can impact the cost of coverage include:

- The location of your event

- Current weather patterns in your area

- Previous weather trends in your area

It's often recommended to get event weather insurance at least 14 days in advance of your scheduled event. Work together with a local independent insurance agent to find affordable rain insurance near you.

An Independent Insurance Agent Can Help You Get Event Weather Insurance

Organizing a special event can be time-consuming and expensive, and the possibility of all your hard work being lost due to inclement weather can really add to the load. Luckily, a local independent insurance agent can help you find all the rain insurance or inclement weather insurance you need to protect your special events against adverse weather.

Your agent can shop and compare quotes from multiple insurance companies to help you find the best deal. And down the road, they'll still be there to help you file claims or update your coverage as necessary.

https://www.eqgroup.com/rain-insurance/

https://www.eventsured.com/rain-insurance/

https://www.eventinsurancequote.com/weather-insurance/