Nonprofit Insurance and 501(c)(3) Insurance

Nonprofits and 501(c)(3)s aren’t immune to common risks faced by all kinds of businesses, including theft, cybercrime, and lawsuits, so having coverage is essential to prevent losses.

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

Though nonprofit organizations and tax-exempt nonprofits, also known as 501(c)(3)s, have some key distinctions from other businesses, they still face many of the same common hazards on a daily basis. Nonprofits and 501(c)(3) businesses aren’t immune to risks like theft, cybercrime, or even lawsuits, so it’s critical for them to be equipped with the proper coverage. Having nonprofit insurance can help you get the reimbursement you deserve after a potentially hefty loss.

Fortunately, an independent insurance agent can help you find the right nonprofit insurance to protect your organization. They'll learn about your nonprofit or 501(c)(3) business and identify its exact coverage needs to find the ideal policy. But first, here’s a deep dive into this important coverage.

What Is Nonprofit Insurance?

Essentially a special form of business insurance, nonprofit insurance is an agreement between the nonprofit organization and an insurance company in which the insurer agrees to cover financial losses relating to damages and liabilities that befall the organization.

However, the insurance company will only cover the specific perils stated in the policy, ranging from work vehicle accidents to worker injuries. Nonprofit insurance is designed to help nonprofit organizations stay afloat should disaster strike. This coverage can also be applied to tax-exempt nonprofits, known as 501(c)(3)s.

Who Needs Nonprofit Insurance or 501(c)(3) Insurance?

Nonprofit organizations are mostly like any other organization, with the major difference that they don’t turn a profit. A 501(c)(3) specifically is a type of organization that has been granted tax-exempt status by the IRS, which requires them to have a unique form of coverage.

The following are common examples of nonprofit organizations that require special coverage:

- Federal credit unions

- Charitable organizations

- Scientific organizations

- Amateur sports associations

- Public safety testing organizations

- Religious organizations (e.g., churches)

- Social welfare groups

- Politically motivated groups

- Rotary clubs

- Volunteer fire stations

- Labor unions

- Agricultural unions

- Social and recreational clubs (e.g., country clubs)

This is not an exhaustive list of nonprofit or 501(c)(3) organizations. Your independent insurance agent can help you determine if your organization needs nonprofit insurance.

Why Do I Need Nonprofit Insurance or 501(c)(3) Insurance?

Just like other kinds of organizations, nonprofits and 501(c)(3)s face numerous common perils. To keep your organization protected, it needs coverage tailored to address the specific possible risks it’s up against on a routine basis. Nonprofit organizations and 501(c)(3)s need protection against the following:

- Lawsuits and liabilities

- Theft

- Employee misconduct

- Volunteer misconduct

- Cybercrime and data breaches

- Auto accidents

- Property damage

- Vandalism

- Natural disasters

- Event-related mishaps

- Professional errors

- Worker injuries and illnesses

Talk to your independent insurance agent about the responsibilities of your nonprofit organization or 501(c)(3) to get set up with all the coverage necessary in every area.

Who Sells Nonprofit Insurance or 501(c)(3) Insurance?

Nonprofit insurance or 501(c)(3) insurance is available from many different insurance companies, and the best way to find the right carrier for you is through working with an independent insurance agent.

While many insurance companies could create a nonprofit insurance policy or 501(c)(3) insurance policy for you, finding coverage could also depend on the area you live in. Here are just a few of our top picks:

| Top Nonprofit and 501(c)(3) Insurance Companies | Overall Carrier Star Rating |

| Liberty Mutual |

|

| Progressive |

|

| Travelers |

|

| The Hartford |

|

- Best overall nonprofit insurance company: Liberty Mutual

Liberty Mutual has been in the insurance industry since 1912 and is rated "A+" by the Better Business Bureau and "A" by AM Best. This Fortune 500 company also offers one of the best nonprofit insurance products available.

While many insurance companies only sell separate coverages recommended for nonprofit organizations, Liberty Mutual combines these all into one convenient package for customers in every state except Hawaii and Louisiana.

Liberty Mutual's nonprofit insurance policies include the following coverages:

- Professional liability insurance

- Health care liability insurance

- Property insurance

- Umbrella insurance

Policies also come with the following optional add-ons:

- Sexual/physical misconduct coverage

- Employee benefit liability insurance

- Equipment breakdown insurance

With a high volume of customer satisfaction, Liberty Mutual provides trustworthy, reliable coverage for nonprofit organizations of all kinds in need of critical protection.

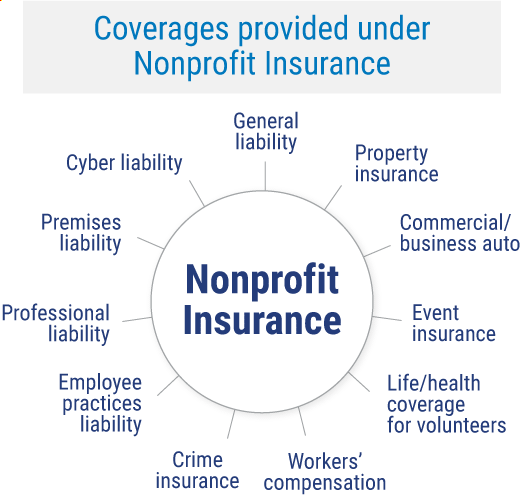

What Types of Coverage Do Nonprofit and 501(c)(3) Organizations Need?

Nonprofit insurance and 501(c)(3) insurance are designed to protect organizations against all types of threats. Your policy will include the basics of business insurance coverage, with several coverages tailored specifically to your nonprofit added on.

The more risks involved in your unique organization, the more coverage you’ll need, but here is a handful of commonly selected coverages in nonprofit insurance packages to start off. Your nonprofit insurance package can be assembled from a combination of the following coverages:

- General liability insurance: Covers the cost of lawsuits related to third-party claims of bodily injury or personal property damage.

- Commercial property insurance: Covers company property, including buildings, inventory, and equipment against theft, damage, etc.

- Commercial auto insurance: Covers company vehicles against costs related to liability, accidents, theft, etc.

- Premises liability insurance: Covers the cost of third-party claims from incidents that occur on your organization's premises.

- Cyber liability insurance: Covers costs associated with cyber-attacks and data breaches that may expose sensitive or private data.

- Professional liability insurance: Covers costs related to third-party lawsuits for professional errors or omissions by your organization that lead to some kind of harm.

- Employment practices liability insurance: Covers costs related to employee claims against your organization for sexual harassment, discrimination, wrongful termination, etc.

- Crime insurance: Covers losses related to acts of crime against the organization.

- Workers' compensation insurance: Covers employee medical bills and partial wage replacements if a worker gets injured or ill due to the organization's activities or environment.

- Event liability insurance: Covers costs associated with canceled or rescheduled special events due to listed causes.

- Life and health coverage for volunteers: Covers health and death benefits for volunteers of the organization, depending on the type of policy chosen.

An independent insurance agent can help you build a complete nonprofit insurance or 501(c)(3) insurance policy.

Is a Business Owners Policy Right for You?

A business owners policy, or BOP, is a good option for some nonprofit organizations and 501(c)(3)s and can provide much of the coverage you need at an affordable rate. In addition to liability and commercial property, other coverage options include:

- Business income insurance: Covers loss of income for up to 12 months due to business interruptions stemming from covered losses.

- Equipment breakdown insurance: Covers mechanical breakdowns and other causes of equipment malfunction.

- Rental vehicle coverage: Covers loss or damage to vehicles you borrow or rent.

An independent insurance agent can help you decide if a BOP is right for your nonprofit or 501(c)(3) organization.

What’s Not Covered by Nonprofit Insurance or 501(c)(3) Insurance?

While nonprofit insurance provides coverage for many potential sources of harm for these organizations, it doesn’t cover everything. While exclusions may vary by policy and the type of coverage required by your specific organization, there are a handful of commonly non-covered perils under nonprofit insurance, including:

- Intentional harm

- Regulatory/statutory penalties

- Employee dishonesty

- General wear and tear of equipment, etc.

- Routine maintenance fees

- Earthquake damage

- Nuclear reaction and war

- Pollution

- Temperature/humidity changes

- Inexplicably lost inventory

- Flood damage*

*If your nonprofit organization is located in an area prone to flooding, such as along the coast, you’ll most likely want to purchase additional flood insurance coverage for your premises, or you may even be required to have it by your mortgage lender. Your independent insurance agent can give you more information about finding coverage.

How Much Does Nonprofit Insurance or 501(c)(3) Insurance Cost?

The cost of coverage depends on a number of factors. Nonprofit organizations might pay just a few hundred dollars per year, or they might pay well into the thousands, depending on the size and scope of operations and services offered.

Unfortunately, it’s hard to offer an average figure since each nonprofit is unique. Some factors that can influence coverage costs include:

- The type of nonprofit or 501(c)(3): This includes whether your organization is a church, country club, etc. Additionally, the specific services offered by your nonprofit will affect its risk level to insure.

- The location of the organization: Larger cities tend to have higher costs for insurance. Depending on your nonprofit’s specific location, it may be more prone to various weather-related risks. Nonprofits located along the coast may have premiums up to 20% higher due to the increased risk of hurricane damage.

- The number of employees/volunteers: Insurance costs for organizations with more helpers will be higher due to the increased need for workers' comp. coverage.

- The size of the organization: The larger the reach of a nonprofit, the greater its exposure and the more coverage it requires.

| Policy | Median Monthly Cost | Median Annual Cost |

|---|---|---|

| General liability insurance | $45/month | $500/year |

| Workers' compensation | $80/month | $980/year |

| BOP insurance | less than $70/month | $810/year |

| Professional liability insurance | less than $50/month | $575/year |

Your independent insurance agent can work with you to find a policy that fits within your nonprofit’s budget. Have your financial restrictions in mind before you start shopping for coverage to help speed the process along.

Finding Discounts and Savings on Nonprofit Insurance and 501(c)(3) Insurance

Though nonprofit insurance costs can vary widely, many insurance companies offer competitive discounts and other ways to save money on their coverage. Available discounts will vary depending on which insurance company you choose, but here are some common discounts offered on nonprofit insurance policies:

| Safe business vehicle storage discount: |

| You may qualify for a discount on the commercial auto section of your nonprofit insurance if you store your organization's vehicles in a garage or other enclosed area while not in use. |

| Annual premium discount: |

| You may qualify for a discount on nonprofit insurance if you choose to pay premiums annually vs. in monthly installments. |

| Insurance package discount: |

| You may qualify for a discount on nonprofit insurance if you shop for a special packaged product that includes all the protections you need, vs. purchasing each required type of coverage separately. |

| Firewall discount: |

| You may qualify for a discount on the cyber liability coverage section of your insurance if your organization takes extra measures to keep its digital information safe from cyber breaches, such as installing firewalls and requiring additional passwords. |

| Safe premises discount: |

| You may qualify for a discount on your nonprofit coverage if you can prove to the insurance company that your nonprofit's environment is safe for your workers and the organization makes an effort to reduce injuries, illness, etc. |

| Bundling discount: |

| You may also qualify for discounts on nonprofit insurance if you purchase additional policies through the same insurance company. |

An independent insurance agent can help you find the most affordable rates by browsing a number of different insurance companies’ nonprofit insurance products.

Comparing Nonprofit Insurance and 501(c)(3) Insurance Plans

Though a handful of general coverages are offered by many insurance companies under the name of nonprofit insurance or 501(c)(3) insurance, these options and available selections can also vary depending on your location and several other factors.

To get set up with all the crucial protection your nonprofit organization deserves, the best course of action is to enlist the help of an independent insurance agent. Not only do independent insurance agents know which coverages nonprofit organizations need, but they also know which insurance companies offer these policies at the most affordable rates.

Frequently Asked Questions about Nonprofit Insurance

Regardless of whether a nonprofit is legally required to have coverage, there are a couple of insurance types that an organization must carry at all times to keep itself safe. Worker's compensation is critical to protect any workers from injuries, illness, or death while on the job, and general and professional liability insurance is really non-negotiable to protect your organization from various lawsuits. In fact, certain clients won't work with your organization at all if you lack insurance.

It's easy to get these classifications confused. Here's a simple breakdown: A nonprofit is a specific kind of entity, often a corporation, that's established for a nonprofit purpose. A 501(c)(3), often mistakenly referred to as a 503c, is a type of nonprofit organization that's been given tax-exempt status by the IRS. Tax-exempt status stems from the nature of the organization's offerings, often charitable programs.

The purpose of nonprofit insurance is to provide crucial protection in a number of ways. Beyond the nonprofit’s physical office building, many components of your organization stand to be destroyed or otherwise harmed by common threats.

To determine how much nonprofit insurance you need, you'll want to enlist the help of a trusted independent insurance agent. Together, the two of you will assess your specific organization's risk areas and get all the coverage you need to protect each of them adequately. You'll consider how much protection you need for things like your team, your organization's vehicles, your organization's building, and your clients.

The Benefits of an Independent Insurance Agent

Independent insurance agents have access to multiple nonprofit and 501(c)(3) insurance companies near you. They're free to shop and compare quotes and policy options from many different carriers so they can present you with only the best options. And down the road, your agent can help you file business insurance claims and update your coverage as necessary.

https://www.501c3.org/frequently-asked-questions/does-nonprofit-501c3-and-tax-exempt-all-mean-the-same-thing/#:~:text=Actually%2C%20no!,virtue%20of%20its%20charitable%20programs.

https://www.thehartford.com/business-insurance/nonprofit-insurance

https://www.insureon.com/nonprofit-business-insurance