Best Group Disability Coverage

(The basics of short-term and long-term group disability insurance)

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

You just started a new job and they’re offering you disability insurance. You can choose short-term or long-term or neither, and there are different limitations and guidelines for each. Before you know it your head is spinning abut whether you even need this type of policy.

That’s where our independent insurance agents step in. They’re here to help you understand the different options when it comes to group disability insurance and show you how to pick what will work for you.

What Is Group Disability Insurance?

Group disability insurance is an insurance policy that is offered by employers to their employees. It will pay a portion of your income should you become ill or injured and not be able to return to work.

The illness or injury cannot be work-related, otherwise, that would be workers’ compensation. And depending on the severity of the disability, you’ll either need short-term or long-term group disability insurance.

Is Group Disability Insurance Required?

No, an employer is not required to offer group disability insurance and you are not required to accept the insurance if your employer does offer it. Most companies that offer group disability insurance do it so they can have a more comprehensive benefits package.

However, if your employer does offer group disability insurance, it will most likely be less expensive to purchase it through them than on your own. But you are able to purchase individual disability insurance if you feel the option your company is offering is not sufficient.

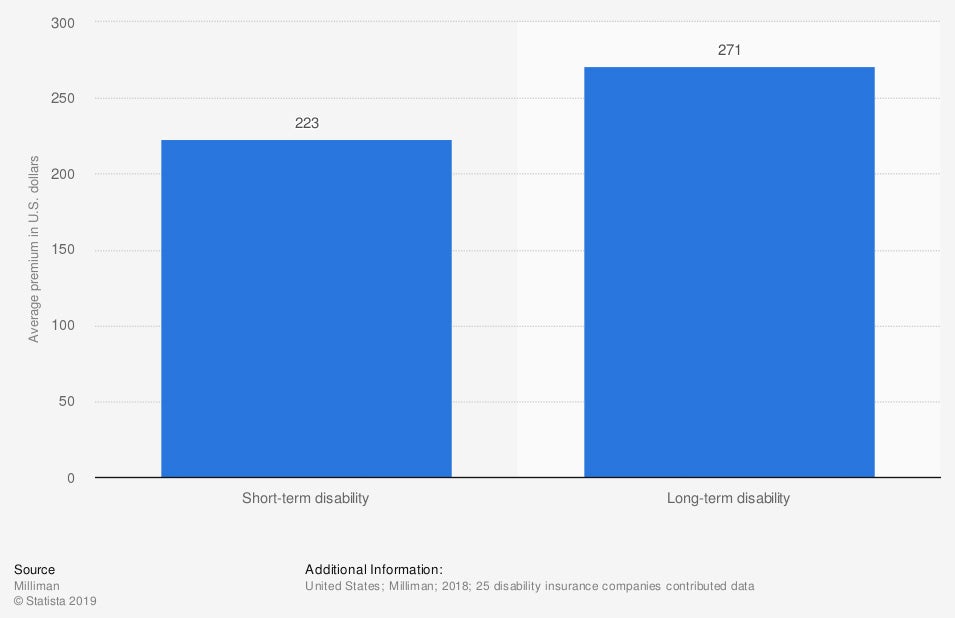

Average Group Disability Insurance Premium

In 2018 the average short-term disability insurance premium was $223, while the average long-term disability premium was $271. Data was taken from 25 disability insurance companies.

What Types of Group Disability Insurance Exist?

There are two main types of group disability insurance, short-term and long-term.

- Short-term disability insurance: This will pay a portion of your income, usually 50%-65%, for a specified and short amount of time. This time frame is usually three to six months, and some companies go up to two years. Once you’ve reached the end of your short-term disability, you can get evaluated to see if you need to switch to long-term disability if you are unable to return to work. Of course, you cannot move to long-term disability if you haven’t previously purchased a policy.

- Long-term disability insurance: This will pay a portion of your income, usually 50%-60%, for an extended period. This time frame is measured in years and can be two, five, or ten years, or until retirement at age 65.

There are some key differences between these two options that you want to consider when doing your research.

Differences between short-term and long-term disability

| Short-Term | Long-Term |

| Benefits cover a shorter amount of time, usually 2-26 weeks. | Benefits are for a longer time frame. |

| You cannot perform your OWN occupation. | You cannot perform your OWN occupation. |

| Includes pregnancy and birth. | You cannot perform ANY occupation. |

| Lower monthly premiums. | Higher monthly premiums. |

| Shorter waiting period (called elimination period). | Longer waiting period (called elimination period). |

| Suffering from less serious injury or illness. | Continue even if you lose your job. |

| Ends if you lose your job while out on disability. | Can qualify and receive benefits from workers’ compensation and long-term disability. |

| Cannot receive short-term disability and workers' compensation. |

There are also different types of protection within a policy if you’re purchasing it yourself.

- Guaranteed renewable: This type of policy means you can renew your policy every year with the same benefits and that the insurance company cannot cancel your policy. However, the insurance company does have the right to increase your premium.

- Noncancellable: This means that the insurance company can only cancel your policy if you don’t pay your premium. With noncancellable disability insurance, the insurer cannot increase your premium or reduce your benefits.

Some employers will offer short- and long-term policies, others will offer one or the other, and some will offer none. No matter what your employer provides, you can purchase individual disability insurance through your independent insurance agent.

Is Short-Term or Long-Term Disability Insurance Better for Me?

Determining whether short-term or long-term disability insurance is better for you comes down to what’s being offered by your company, your financial situation, and some other factors.

One thing to keep in mind is some of the stats when it comes to disability in the US.

- More than one in four of today’s 20-year-olds will be out of work for more than a year because of a disability before they hit retirement age.

- 5.6% of Americans will experience a short-term disability in their lifetime.

- The average disability lasts three months.

As with anything, there are pros and cons to both short-term and long-term disability insurance.

- Short-term pros: This insurance will supplement your income, usually between 50%-65%, for a set period. It is also usually very affordable when offered through an employer.

- Short-term cons: You’ll most likely have a cap on your coverage in terms of the amount paid and the length of time you’ll receive benefits. There is also a waiting period before you can receive benefits. This period is usually only 7-14, days but can go up to 30 days.

- Long-term pros: This insurance will supplement your income, usually between 50%-60%, for an extended period. There are no restrictions on how you can spend the money, it’s tax-free, and you never have to pay it back.

- Long-term cons: It can get pricey to pay the premium for long-term disability insurance that you may never use. Long-term disability insurance also comes with more limitations and can be more expensive as you get older and have preexisting conditions.

You can also ask yourself the following questions to help determine whether a short-term or long-term disability policy is best for you.

- If you were to fall ill or get injured and not be able to work, how many months could you afford to be out of work on your savings?

- How risky do you live?

- What are the odds of getting injured or ill outside of work?

- Do you plan on getting pregnant?

- What percentage of your income do you spend on your bills?

- What benefits does your employers' group disability insurance offer?

Every person is different in their insurance needs. For some, disability insurance is enough, and for others it's recommended that you combine it with other policies such as life or individual insurance.

Working with an independent insurance agent can help you determine whether short-term, long-term, or a different insurance policy is what’s right for you.

What Group Disability Policies Are the Best?

When it comes to choosing a group disability policy, you don’t get much say in the matter. Your employer will offer what they offer. However, there are some insurance companies that are more reputable for having good disability insurance. Those include:

- Assurity

- Guardian Life

- Illinois Mutual

- PIU (Petersen International Underwriters)

- MassMutual

- Mutual of Omaha

- Ohio National

- Principal Financial Group

- The Standard

- Ameritas

If you find yourself shopping around for your own disability policy, keep the following in mind.

- Price

- Added features

- Limitations

- Your occupation

While every company will offer different rates, there are a few ways you can keep your rates down.

- Start early: The older you become, the more of a risk you are for illness or injury. Investing early will keep your premiums low.

- Avoid exclusions: Some health problems are excluded from policies. The longer you wait, the more likely you are to have a symptom that may be excluded should it put you out of work in the future.

- Stretch the elimination period: The elimination period is the amount of time before you start receiving benefits. Have an emergency fund so you can stretch the waiting period as long as possible. The longer you wait for benefits, the less expensive they'll be.

- Get a noncancellable contract: This means that the insurance company can never cancel your benefits unless you don’t pay your premium.

- Get increased coverage: You can increase your coverage as needed, let’s say if your income increases. Always opt for increasing your coverage, which may be called a “future increase option” or “future purchase option.”

- Know what your employer offers: Some companies will auto-enroll you in short-term disability, but you always have to opt in to long-term disability insurance. If your employer offers a long-term option, take advantage of it. The premium will be lower than you can get on your own.

- Take the “own occupation” rider: This feature says that you can still collect benefits as long as you’re unable to work in your original occupation, even if you can work in a different occupation.

Why Independent Insurance Agents?

Disability insurance policies can be complex, and searching through options can be confusing, time-consuming and frustrating. An independent insurance agent's role is to simplify the process.

They’ll make sure you get the right coverage that meets your unique needs. Not only that, they’ll break down all the jargon and explain the nitty-gritty, so you understand exactly what you're getting.

And in the unfortunate event that you need to file a claim, you won’t be alone. Your agent will be right there to help guide you through every last step so you can keep paying for your life. How great is that?

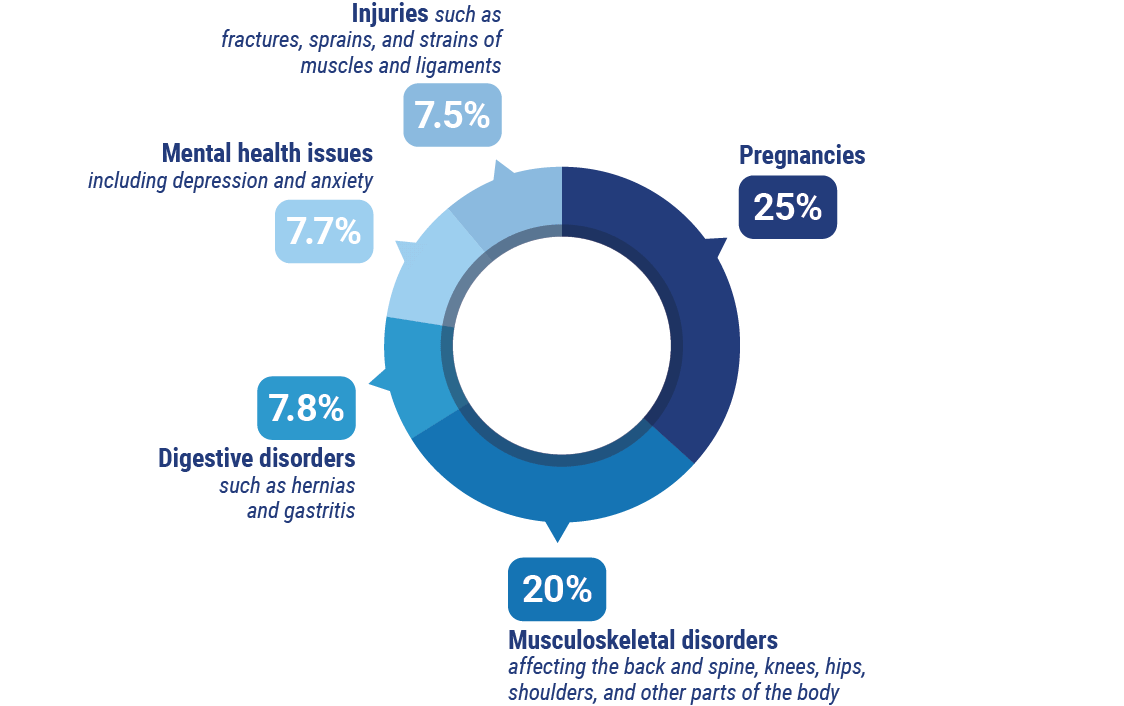

Examples of most common short-term and long-term disabilities

Short-Term Disabilities:

- Pregnancies (25%)

- Musculoskeletal disorders affecting the back and spine, knees, hips, shoulders, and other parts of the body (20%)

- Digestive disorders, such as hernias and gastritis (7.8%)

- Mental health issues, including depression and anxiety (7.7%)

- Injuries such as fractures, sprains, and strains of the muscles and ligaments (7.5%)

Long-Term Disabilities:

- Musculoskeletal disorders (29%)

- Cancer (15%)

- Pregnancy (9.4%)

- Mental health issues, including depression and anxiety (9.1%)

- Injuries such as fractures, sprains, and strains of the muscles and ligaments (9%)

https://www.consumerreports.org/money/smart-strategies-for-selecting-long-term-disability-insurance/

https://disabilitycanhappen.org/disability-statistic/