It’s fair to say that we have our finger on the pulse of insurance consumer behavior with millions of shoppers visiting TrustedChoice.com every year. This is especially true for business insurance buyers, who made up over 56% of our shopping traffic in 2021.

With all this valuable data at our fingertips, we were curious. Which industries are buying insurance more than ever? Which industries are less active than usual? What types of insurance are businesses looking for and when are they most actively searching? And so, our scientists pulled together transactional data from TrustedChoice.com from the last three years to examine buying trends pre-pandemic, mid-pandemic and post-pandemic.

As a result, we uncovered six key findings that show a strong correlation between current socioeconomic factors and insurance buying trends.

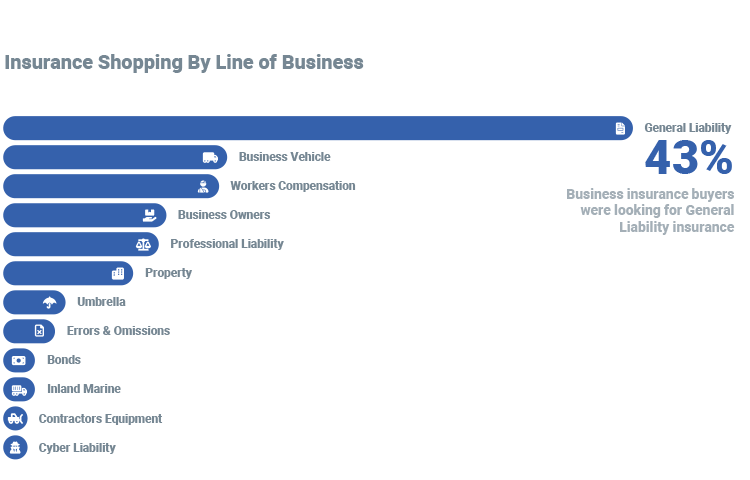

1) General Liability is requested most often by business insurance shoppers

This year, general liability remains the most popular type of insurance coverage sought out on TrustedChoice.com. In fact, it is over three times more popular than the second most popular line of business, Business Vehicle. Here’s what else is in our top 10…

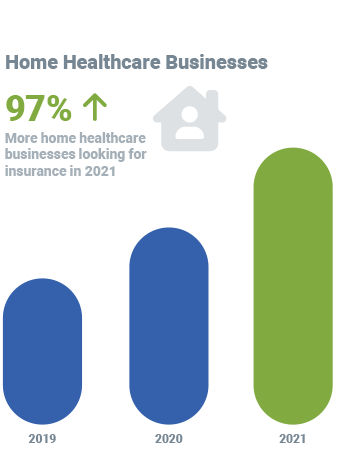

2) Demand from Home Healthcare businesses is up

The number of shoppers looking to insure their home healthcare businesses have nearly doubled since the pandemic, increasing 38% in 2020 and another 42% this year. This accounts for a net increase in transactions of over 97% since 2019.

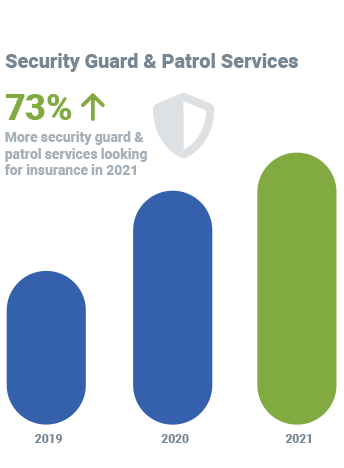

3) Security Guard and Patrol services growing steadily

With businesses being required to implement restrictive containment measures due to social distancing, it is no wonder that the demand from security businesses has grown. The number of transactions for this type of business jumped over 51% in 2020 and has climbed even higher still in 2021, increasing a total of 73% since the pandemic.

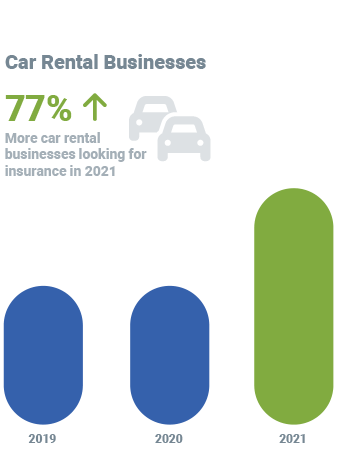

4) Car Rental businesses take a major jump in 2021

It appears that Americans are hitting the road in higher numbers coming out of the pandemic, at least according to our shopping stats. In 2021 the number of car rental companies looking for insurance went up 77% after remaining steady in 2019 and 2020.

5) Local Delivery and Messenger Services are down post-pandemic

While lockdowns and social distancing of 2020 likely caused the 35% increase in demand in insurance for delivery services that year, we are now seeing a similar decrease in demand this year as people venture out of their homes post-pandemic. In 2021 the number of transactions for local delivery and messenger services went down 39%.

6) March is the top month to shop

March is surprisingly hot when it comes to insurance shopping. Our highest number of transactions happen this month for both commercial and personal lines. Conversely, December is the least popular month for insurance shopping across the board. And for consumers looking for Life Insurance, they are most likely to shop in January.

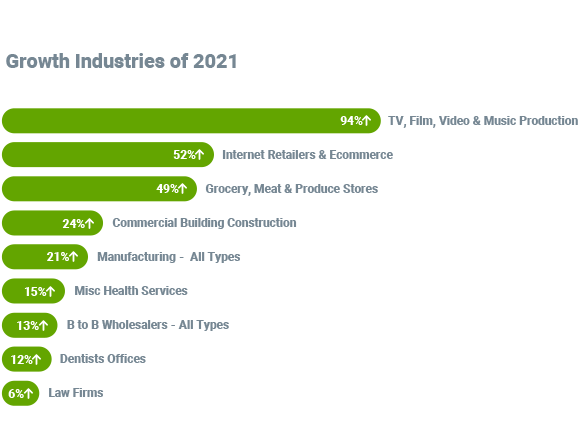

Bonus! Our list of growth industries for 2021

Our SEO traffic experts are constantly working behind the scenes to make it easier for insurance consumers to find an agent on TrustedChoice.com through organic search. So no matter what a shopper is looking to insure or what type of insurance they need, our goal is for TrustedChoice.com to show up near the top of their search results. Here is a list of some of the industries we worked to grow over the past year, yielding more agency opportunities than the year prior.

Additional Resources

As an agent on TrustedChoice.com, you may very well have seen these trends reflected in the types of referrals you receive from us each month. Need help finding a market for an industry that is new to you? You can find trusted insurance companies serving the hottest markets of 2021 using our new market finder app!