Insurance Deductibles: A Breakdown of How They Work

Jeff Green has held a variety of sales and management roles at life insurance companies, Wall street firms, and distribution organizations over his 40-year career. He was previously Finra 7,24,66 registered and held life insurance licenses in multiple states. He is a graduate of Stony Brook University.

Insurance provides a feeling of relief for many, but policies can also come with a lot of confusing technical terms and aspects, like deductibles. It's important to understand what role a deductible plays, if any, in each type of insurance you have. Knowing what all parts of your insurance contract mean can help you get the most out of your coverage.

Fortunately, an independent insurance agent can help you understand every aspect of your policy and help you find coverage if you're in need. Whether it's for your home, or car, or something else, they'll help you get set up with coverage long before you have to use it. But first, here's a breakdown of insurance deductibles, the role they play, and what they're all about.

What Is an Insurance Deductible?

Broken down, an insurance deductible is the amount you're responsible for paying on your own after filing a claim. If your claim is accepted, you'll be required to pay your deductible amount before the insurance company steps in to cover the rest, up to your policy's limit. It's called a deductible because this amount is essentially "deducted" from your payout.

Policies with higher deductible amounts will often carry the reward of a lower monthly or yearly premium. Your deductible might be a percentage of your total coverage, such as 10%, or a dollar amount, such as $500. When working with an independent insurance agent, you'll review all aspects of a policy before you walk away with that coverage. You can often choose your deductible amount up front.

How Does an Insurance Deductible Work?

An insurance policy is a type of contract between a customer and insurance company or carrier, in which the carrier agrees to pay for certain covered losses up to the policy's limit. But the customer also has a responsibility in that contract, which is to fulfill the deductible amount on their own. Basically, the deductible is your end of the bargain when it comes to insurance.

With the help of an independent insurance agent, you can select the deductible amount you're comfortable with. Next, you'll find out how much the carrier will pay for covered losses, and how much they'll charge you for a premium. You might want a policy with a lower deductible so you don't have to pay as much in the event of a loss, but you'll probably pay higher premiums in exchange.

Insurance Deductible Examples

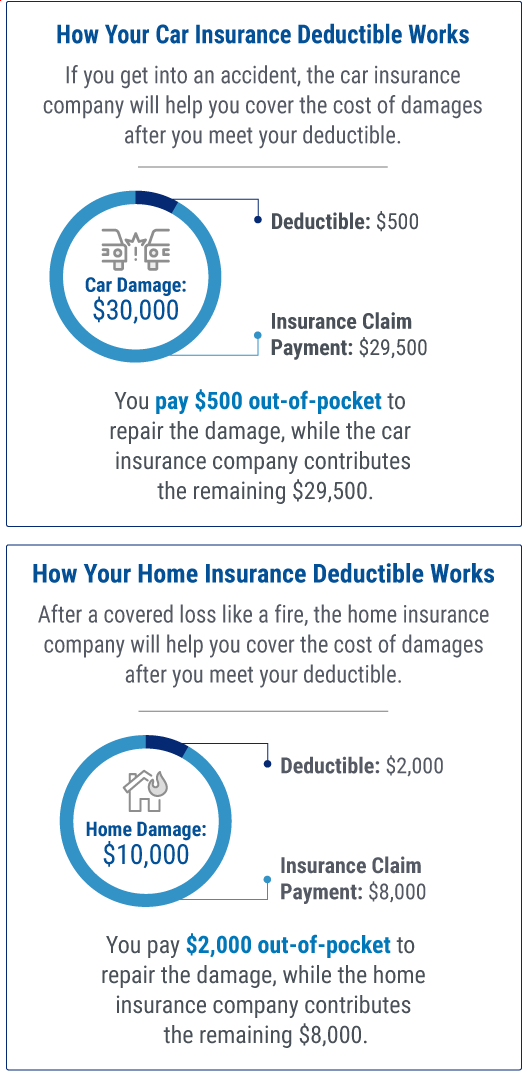

Many of your insurance policies probably have a deductible, and they operate in similar, yet different, ways. Here are a couple of common examples of various deductibles.

- Car insurance: A common car insurance deductible amount is $500, and a common limit for collision coverage is $50,000. If you get into a covered accident that costs $30,000 in damage, you'd pay $500, the car insurance deductible, towards this yourself, and your insurance company would pay the remaining $29,500.

- Home insurance: Your home insurance may have separate deductibles in each category of coverage, such as for the dwelling and for its contents. Say you have a $100,000 home insurance policy with a 2% deductible. After a covered loss like a fire, you'd pay $2,000 towards the damage yourself, and the insurance company would cover the rest, up to the policy limit.

- Endorsements or riders: If you have a special type of coverage called an endorsement or rider added to a policy such as your home insurance, this aspect of coverage may not come with a deductible. With home insurance, sometimes customers purchase riders for expensive personal property, like jewelry. Riders can greatly increase coverage for certain things, and help you avoid a deductible payment.

If you have further questions about how the deductible in your insurance policy operates, your independent insurance agent can help clear up any remaining confusion.

How Much Is the Deductible?

Deductible amounts are regulated by your state. The amount of your deductible can often be decided upon when signing up for coverage, but it's also listed in the terms and conditions of your insurance agreement. Your independent insurance agent can further explain your state's laws regarding deductibles in your area, as well as help you find a policy with a deductible that works best for you.

Who Decides How Much the Deductible Will Be?

Deductible amounts vary depending on the type of coverage you're looking for, such as home insurance or car insurance. The deductible may be a fixed dollar amount or a percentage of your total coverage limit. Often a lower deductible means a higher insurance premium cost, and vice versa.

There are some tricks to saving money on your deductible. One is to bundle a couple of types of coverage together through one insurance company, such as your home and car insurance policies. Often when you bundle policies, you have the convenience of just one deductible for both coverages. You'll want to work with an independent insurance agent to get the best deals on deductibles and coverage.

Insurance Deductibles vs. Out-of-Pocket Costs

It's important to understand what you're responsible for paying when you enter into an insurance contract. Depending on the coverage you have, you may have both a deductible and an out-of-pocket maximum. Fortunately there are some key differences to help you tell these apart.

| Insurance deductible | Out-of-pocket minimum |

| The amount you must pay yourself before insurance reimbursement kicks in | The most you'll have to pay for covered costs within a year |

| Often a percentage of your total coverage or a dollar amount | Often a high dollar amount |

| Payment can go towards out-of-pocket maximum | Insurance company covers 100% of costs after out-of-pocket max is reached |

| Included in many insurance plans | Only available in some plans |

In many cases, after you pay your deductible, your insurance company will start paying towards covered claims. Some types of insurance, however, also come with an out-of-pocket maximum amount, which is the total amount of money the policyholder can be responsible for that year.

More about Deductibles vs. Out-of-Pocket Maximums

In the case of health insurance, many plans come with deductibles, copays, and out-of-pocket maximums. Once a policyholder has met their deductible, they'll begin just paying their copayment towards covered services, and the insurance company will cover the rest.

But if that health insurance plan has an out-of-pocket maximum, the policyholder will not exceed paying this much money total on their own for the whole year. This includes the deductible payment and copayments or coinsurance. Once the out-of-pocket max is met, the insurance company covers all costs.

Raising Your Deductible Amount Could Save You Money

A popular way to save money on common insurance, like home or auto insurance, is to increase your policy's deductible, which can lead to lower premiums. Increasing low deductible amounts to $500 or even $1,000 can make a noticeable difference on your premium payments.

Many home insurance companies offer minimum deductibles of $500 or $1,000. Just keep in mind that if you have a covered loss like a fire or other disaster, you'll have to pay this deductible amount yourself. An independent insurance agent can help you make an informed decision about increasing your deductible.

What Is a Minimum Deductible?

Some insurance companies set minimum deductible amounts in their policies. While you can typically always increase your deductible amount, you may not be able to if there's a set minimum deductible stated in your policy.

Other insurance companies can offer disappearing deductibles or zero deductibles. Make sure to work with your independent insurance agent to find out if your policy's deductible has a minimum or if the option is available to have zero deductible.

Not All Insurance Policies Have Deductibles

When it comes to a policy with zero deductible, you'll often be charged a fee for this in exchange, known as a no-deductible fee. A deductible waiver might also be required to achieve a zero deductible. First consider how much this option might increase your premium costs.

Even policies that come with deductibles for certain claims do not require them for everything. Car insurance, for example, often does not require a deductible be met before reimbursing for a covered liability claim. Review your policies with your independent insurance agent to be sure of how your deductibles apply and when.

How Can Independent Insurance Agents Help?

It’s simple. Independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print, so you know exactly what you’re getting.

There’s no request too small for our gifted independent insurance agents. They have access to multiple insurance companies, ultimately finding you the right coverage with the deductible that works best for you.

https://www.iii.org/article/understanding-your-insurance-deductibles

https://www.irmi.com/term/insurance-definitions/deductible

https://www.irmi.com/term/insurance-definitions/out-of-pocket-costs#:~:text=Out%2Dof%2DPocket%20Costs%20%E2%80%94,coinsurance%2C%20and%20co%2Dpayments.